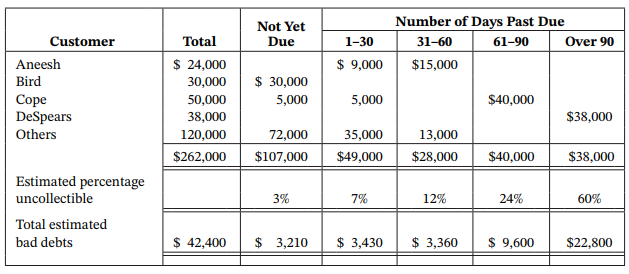

Presented below is an aging schedule for Bryan Company at December 31, 2021. At December 31, 2021,

Question:

Presented below is an aging schedule for Bryan Company at December 31, 2021.

At December 31, 2021, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $8,000.

Instructions

a. Journalize and post the adjusting entry for bad debts at December 31, 2021. (Use T-accounts.)

b. Journalize and post to the allowance account these 2022 events and transactions:

1. March 1, a $600 customer balance originating in 2021 is judged uncollectible.

2. May 1, a check for $600 is received from the customer whose account was written off as uncollectible on March 1.

c. Journalize the adjusting entry for bad debts at December 31, 2022, assuming that the unadjusted balance in Allowance for Doubtful Accounts is a debit of $1,400 and the aging schedule indicates that total estimated bad debts will be $36,700.

Aging ScheduleAging schedule is an accounting table that shows a company’s account receivables. It is an summarized presentation of accounts receivable into a separate time brackets that the rank received based upon the days due or the days past due. Generally...

Step by Step Answer:

Financial Accounting Tools for Business Decision Making

ISBN: 978-1119493631

9th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso