Hampton Corporations statement of financial position at December 31, 2014, is presented below. During 2015, the following

Question:

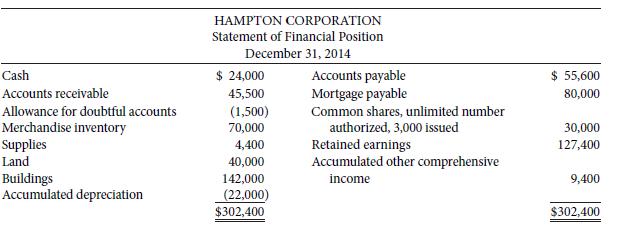

Hampton Corporation’s statement of financial position at December 31, 2014, is presented below.

During 2015, the following transactions occurred.

1. Hampton issued 500 shares of $2.80 cumulative preferred shares for $50,000. Hampton is authorized to issue 50,000 preferred shares.

2. Hampton also issued 500 common shares for $30,000.

3. Hampton sold merchandise for $320,000 on account and $100,000 on bank credit cards. Hampton uses a perpetual inventory system and its cost of goods sold for this total transaction was $250,000.

4. Hampton collected $296,000 from customers on account.

5. Hampton bought $35,100 of supplies on account.

6. Purchased $330,000 of merchandise inventory on account, terms 2/10, n/30.

7. Hampton paid $322,000 on accounts payable related to purchases of merchandise in transaction 6, within the 10-day discount period.

8. Paid salaries of $88,200.

9. An account receivable of $1,700, which originated in 2014, was written off as uncollectible.

10. Paid $2,000 on the mortgage principal during the year, and $4,000 of interest.

11. Near the end of the current fiscal year, Hampton declared the annual preferred share cash dividend of $1,400 and a $4,200 common share cash dividend, to shareholders of record on January 13, 2016, payable on January 31, 2016.

Adjustment data:

1. A count of supplies indicates that $5,900 of supplies remain unused at year end.

2. Estimated uncollectible accounts were $3,500 at year end.

3. Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a residual value of $10,000.

4. Interest of $350 is owed on the mortgage at year end. The current portion of the mortgage due is $2,500.

5. The bank statement included a service charge of $3,000 for bank credit card fees.

6. Income tax of $6,000 is estimated to be due.

Instructions

(a) Record the above summary transactions and adjusting journal entries.

(b) Open T accounts and enter the opening balances at January 1, 2015. Post the above general and adjusting journal entries to T accounts, adding new ones as required.

(c) Prepare an adjusted trial balance as at December 31.

(d) Prepare (1) an income statement, (2) a statement of changes in equity, and (3) a statement of financial position.

(e) Prepare and post closing journal entries to the relevant T accounts set up in part (b).

Step by Step Answer:

Financial Accounting Tools for Business Decision Making

ISBN: 978-1118644942

6th Canadian edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine