A, B and C are partners sharing profits and losses 4/7ths, 2/7ths, 1/7ths respectively. Their Balance Sheet

Question:

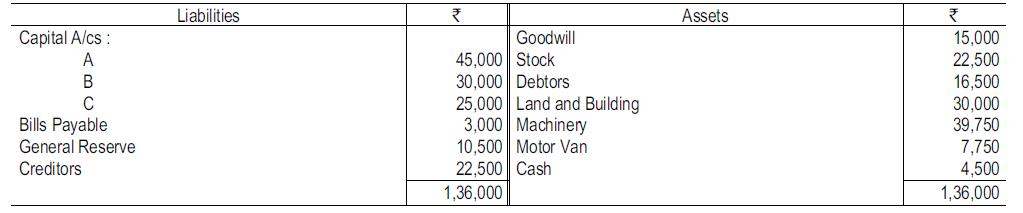

A, B and C are partners sharing profits and losses 4/7ths, 2/7ths, 1/7ths respectively. Their Balance Sheet on 31st December 2017 was as follo On the same date A retired from the business and the following adjustments were made :

On the same date A retired from the business and the following adjustments were made :

(i) Firm’s goodwill was valued at ₹36,000.

(ii) Assets and liabilities are to be revalued as : Stock ₹18,000; Land and Building ₹33,900; Debtors ₹15,750; Machinery ₹37,500; Creditors ₹21,000.

(iii) B to bring in ₹30,000 and C ₹7,500 as additional capital.

(iv) A was to be paid ₹24,300 in cash and the balance of his Capital Account to be transferred to his Loan Account. Prepare Revaluation Account, Partners’ Capital Accounts, Cash Account and the Balance Sheet of the firm after A’s retirement.

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee