A, B and C carrying on business in the partnership decided to dissolve it on and from

Question:

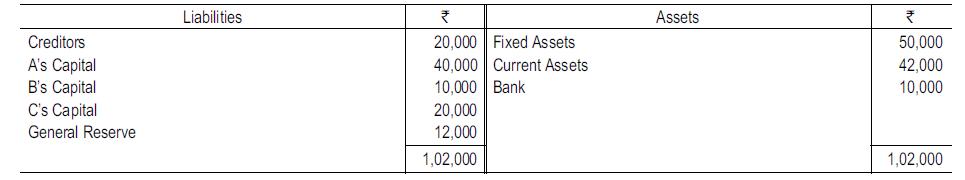

A, B and C carrying on business in the partnership decided to dissolve it on and from 30th September 2017. The following was their Balance Sheet on that date:

As per the arrangement with the bank, the partners were entitled to withdraw an amount of ₹5,000 only at present and the balance amount of ₹5,000 could be withdrawn after 1st December, 2017. It was actually withdrawn on 20th December, 2017.

It was decided that after keeping aside an amount of ₹2,000 for estimated realization expenses the available cash should be distributed between the partners immediately.

The following were the realisations:

Fixed Assets: 31st October, 2017 ₹10,000; 25th November, 2017 ₹26,000; 20th December, 2017 (Final) ₹10,000.

Current Assets: 31st October, 2017 ₹19,000; 25th November, 2017 ₹20,000; 20th December, 2017 (Final) ₹9,000.

Actual realization expenses amounted to ₹1,550 only.

Prepare a statement showing the distribution of cash between the partners applying the ‘‘surplus capital method".

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee