A, B and C give you the following Balance Sheet as on 31.12.2017. The partners shared profits

Question:

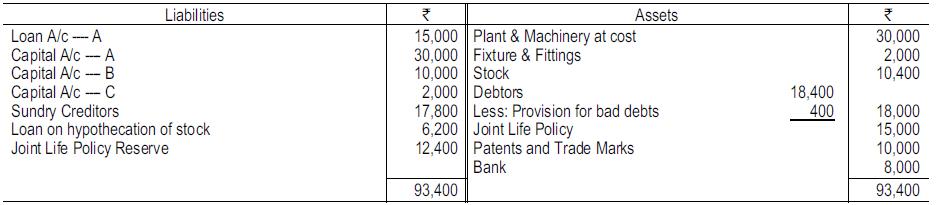

A, B and C give you the following Balance Sheet as on 31.12.2017. The partners shared profits and losses in the ratio of 4:2:3. The firm was dissolved on December 31, 2017 and you are given the following information:

The partners shared profits and losses in the ratio of 4:2:3. The firm was dissolved on December 31, 2017 and you are given the following information:

(a) C had taken a loan from Insurers for ₹5,000 on the security of the Joint Life Policy. The policy was surrendered and insurers paid a sum of ₹10,200 after deducting ₹5,000 for C’s loan and ₹300 interest thereon.

(b) One of the creditors took some of the patents whose book value was ₹6,000 at a valuation of ₹4,500. The balance to that creditor was paid in cash.

(c) The firm had previously purchased some shares in a joint stock company and had written them off on finding them useless. The shares were now found to be worth ₹3,000 and the loan creditor agreed to accept the shares at this value.

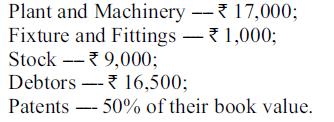

(d) The remaining assets realized the following amounts:

(e) The liabilities were paid and a total discount of ₹500 was allowed by the creditors.

(f) The expenses of realisation amounted to ₹2,300. Prepare the Realisation Account, Bank Account and the Partners’ Capital Accounts

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee