A, B and C were partners sharing profits and losses in the ratio of 5 : 3

Question:

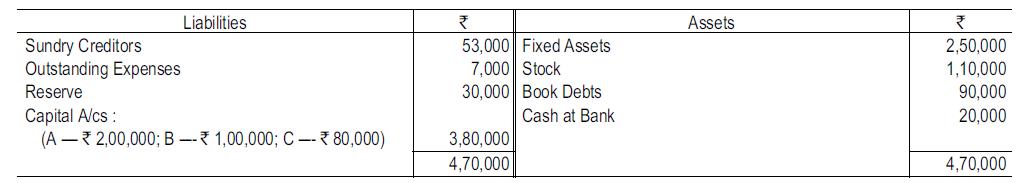

A, B and C were partners sharing profits and losses in the ratio of 5 : 3 : 2 respectively. They had taken out a joint life policy of the face value of ~ 2,00,000. On 31st December, 2017, its surrender value was ~ 40,000. On this date the Balance Sheet of the firm stood as follows :

On that date B decided to retire and for that purpose :

(a) Goodwill was valued at ₹1,50,000

(b) Fixed assets were valued at ₹3,00,000;

(c) Stock was considered as worth ₹10,000. B was to be paid in cash brought in by A and C in such a way so as to make their capital proportionate to their new profit sharing ratio which was to be 3 : 2 respectively. Goodwill was to be passed through books without raising a Goodwill Account; the joint life policy was also not to appear in the Balance Sheet. Prepare Ledger Accounts and the resultant Balance Sheet.

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee