A Ltd acquires a 60 per cent interest in B Ltd on 1 July 2022 for a

Question:

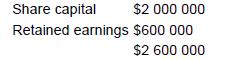

A Ltd acquires a 60 per cent interest in B Ltd on 1 July 2022 for a cost of $2 million representing the fair value of consideration transferred. The management of A Ltd values any non-controlling interest at acquisition date at the proportionate share of B Ltd’s net identifiable assets at acquisition date. All assets are assumed to be fairly valued in the books of B Ltd. The share capital and reserves of B Ltd at the date of acquisition are:

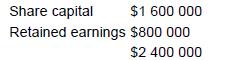

B Ltd acquires a 60 per cent interest in C Ltd on 1 July 2022 for $1.6 million representing the fair value of consideration transferred. Any non-controlling interest in C Ltd at acquisition date is based on fair value. The share capital and reserves of C Ltd at the date of acquisition are:

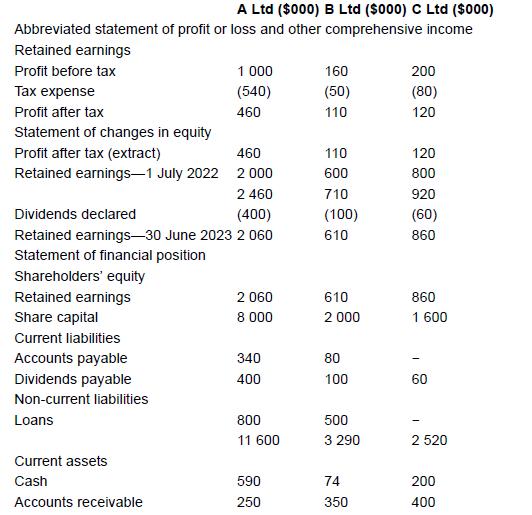

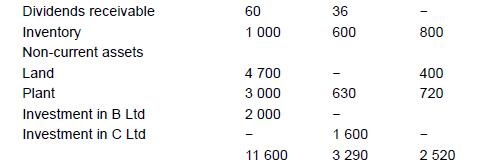

The statements of comprehensive income and statements of financial position of the entities at 30 June 2023 (one year after the acquisitions) are as follows:

Additional information

It is assumed that goodwill acquired has been subject to an impairment loss of 20 per cent of the original goodwill value.

REQUIRED

Present consolidated financial statements for A Ltd and its controlled entities as at 30 June 2023

Step by Step Answer: