A young graduate from Birla Institute of Technology (BIT)-Ranchi, Anand, patents a design for a life saving

Question:

A young graduate from Birla Institute of Technology (BIT)-Ranchi, Anand, patents a design for a life saving injection for a dreaded disease. Devoid of cash, he is not able to commercialize his innovation. Another graduate from BIT, Srinivas, offers to buy out this patent for a sum of ₹A. The scientist Anand, however, is not interested in an outright sale. Meanwhile, Srinivas and a room acquaintance of Srinivas, decide to start a private company to manufacture biomedical equipment. They are on the lookout for a patent and identify Anand. They offer to commercialize his product and acquire rights to the design. In return, they offer to pay Anand a sum of ₹B for each unit of the product sold.

Srinivas and XXX bring in ₹C each as capital and start the company as, Handsome Inc. A bank gives them a loan of ₹D to start their venture. This loan has to be paid back in 5 equal instalments, starting from the first year-end. This amount is deposited in a current account in the company’s name. The interest is to be paid on the first of every month for the previous month at the rate of 18% p.a. on the principal remaining. The bank also grants them an overdraft facility of ₹E.

Handsome Inc. buys up land worth ₹F. The company pays ₹G as down payment and agrees to pay the balance in five instalments of ₹H each, every year. A building worth ₹I is constructed on this site. The useful life of the building is 10 years and the salvage value is ₹J. The depreciation is applied on the WDV method at the rate of 20% p.a.

The company buys machines worth ₹K. While transporting these machines to the factory site, some damages occur, which have to be repaired at a cost of ₹L. The agency in charge of installation of these machines submits a bill of ₹M to the company. Meanwhile, due to a technological breakthrough, the cost of these machines in the market plummet to one fourth their previous value.

The company buys raw material for ₹N. The cost of transporting these to the company warehouse is ₹O.

The company reflects on its strategy and decides to come up with an improvement to the injection. A consultant works on this project for six months and comes up with the 1.2 version of the injection. He charges the company ₹P for this project. However, the company decides that it will not introduce this product till next year.

The company has some excess funds and is looking for ways to use them. A broker offers some stock market tips and charges the company ₹Q. The company makes an investment in the stock market worth ₹R.

The company pays out ₹S to its employees as salary in cash. The other expenses for the company amount to ₹T for the first year.

The company decides to ascertain its financial position at the end of year 1. The accountant of the company comes up with the following additional information:

- The cash and bank balance of the company amount to ₹AA.

- The company owes ₹BB to its suppliers.

- Only 20% of the inventory has been processed.

- All processed inventory has been sold for ₹CC.

- The customers owe the company ₹DD. One of its customers, Vikram, who owes ` DDD has a financial crisis.

- The company has made losses for the current year at ₹U.

- The company during the start of its operations has paid ₹V in insurance and license expenses for four years.

The accountant draws up the balance sheet as on the last day of the first year of operations. The same day, some unforeseen events take place. The investments that the company has made in the stock market fluctuate wildly and settle at ₹W. One of the partners sees an opportunity in some other venture and decides to pull out. He sells off his stock in the company in the market at a profit of ₹X. UNICEF recognizes the importance of this product and awards ₹Y in cash to the company. However, a professor of BIT Ranchi charges Anand and the company of stealing his innovation. He files a suit claiming damages of ₹Z each, from Anand and Handsome Inc.

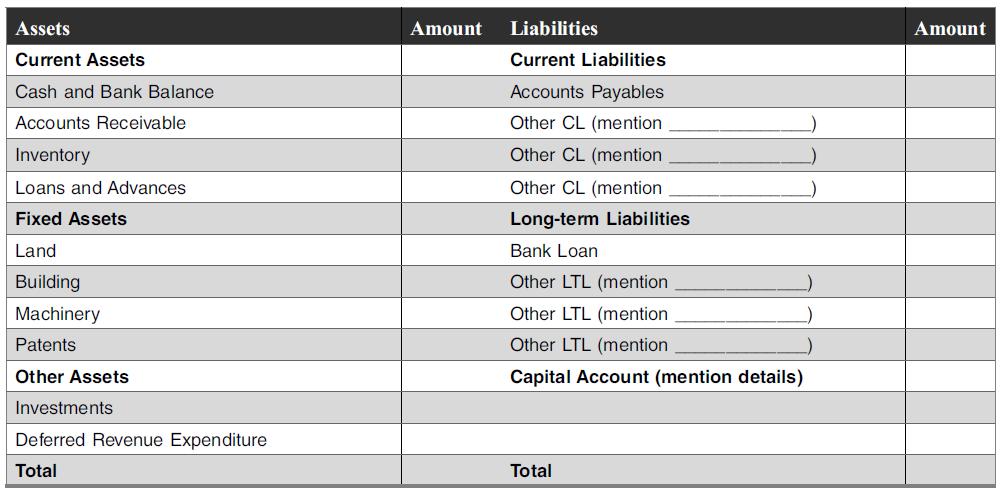

Srinivas asks the accountant to incorporate these developments into the balance sheet of the company immediately. The accountant, however, is thoroughly confused with these developments and messes up these figures. Srinivas has an important meeting with a financial institution for an additional loan of ₹ ZZ and wants the balance sheet immediately. Help Srinivas draw up the balance sheet in the format given below (fill in the blanks).

If you choose to ignore any of the data given, explain why in the space given below:

State all your assumptions clearly (item-wise) in the space given below:

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani