Assume Kaledan Company paid $15 million to acquire Roeder Industries. Assume further that Roeder had the following

Question:

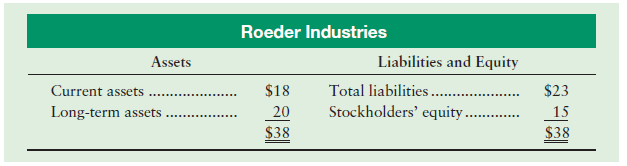

Assume Kaledan Company paid $15 million to acquire Roeder Industries. Assume further that Roeder had the following summarized data at the time of the Kaledan acquisition (amounts in millions):

Roeder’s current assets had a current market value of $18 million, long-term assets had a current market value of only $14 million, and liabilities had a market value of $23 million.

Requirements

1. Compute the cost of goodwill purchased by Kaledan Company.

2. Journalize Kaledan’s purchase of Roeder Industries.

3. Explain how Kaledan will account for goodwill.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted: