Assume the same facts as in P811, except that the FMVs for the inventory and property, plant,

Question:

REQUIRED:

a. Assume that you wish to maximize reported income in the next period. What dollar amounts would you allocate to Rachel€™s inventory, property, plant, and equipment, and goodwill when recording the acquisition? Explain.

b. Assume that you wish to minimize reported income in the next period (e.g., when preparing the transaction for tax purposes). What dollar amounts would you allocate to Rachel€™s inventory, property, plant, and equipment, and goodwill when recording the acquisition? Explain.

Data From Problem 11

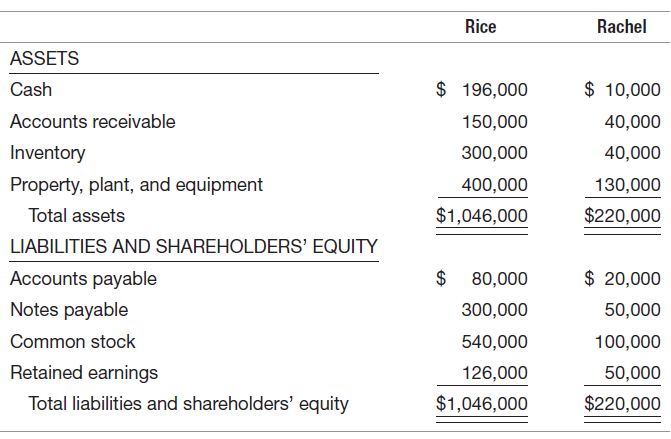

The condensed balance sheets as of December 31 for Rice and Associates and Rachel Excavation are as follows:

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: