Billybang Pty Ltd imports surf shorts and sells them to department stores throughout Australia. At 1 July

Question:

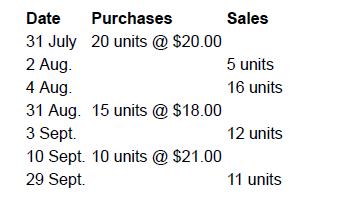

Billybang Pty Ltd imports surf shorts and sells them to department stores throughout Australia. At 1 July 2021 opening inventory comprised 10 units @ $22.00 each. Throughout the quarter ended 30 September 2021, the sales price of surf shorts was $30.00 and distribution costs were $0.50 per unit. Extracts from Billybang’s inventory record reveal the following transactions:

REQUIRED

a. Calculate the cost of goods sold and ending inventory assuming that Billybang Pty Ltd uses the:

- Periodic inventory system with the weighted-average cost-flow method

- Periodic inventory system with the FIFO cost-flow method

- Periodic inventory system with the LIFO cost-flow method

- Perpetual inventory system with the weighted-average cost-flow method

- Perpetual inventory system with the FIFO cost-flow method

- Perpetual inventory system with the LIFO cost-flow method

b. Explain why some entities might prefer a perpetual inventory system to a periodic inventory system.

c. In the US the LIFO cost-flow method has been permitted for a long time and some companies carry inventory at purchase costs that existed decades ago. Why do you think that such companies are typically reluctant to allow inventory to fall to levels that would mean using the longstanding LIFO layers?

Step by Step Answer: