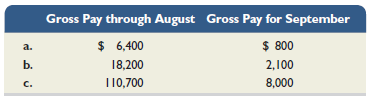

BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $117,000 paid to

Question:

Transcribed Image Text:

Gross Pay through August Gross Pay for September $ 6,400 a. $ 800 2,100 8,000 b. 18,200 c. T10,700

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

Subject to Tax Rate Tax Explanation a FICASocial Security 800 620 ...View the full answer

Answered By

Lamya S

Highly creative, resourceful and dedicated High School Teacher with a good fluency in English (IELTS- 7.5 band scorer) and an excellent record of successful classroom presentations.

I have more than 2 years experience in tutoring students especially by using my note making strategies.

Especially adept at teaching methods of business functions and management through a positive, and flexible teaching style with the willingness to work beyond the call of duty.

Committed to ongoing professional development and spreading the knowledge within myself to the blooming ones to make them fly with a colorful wing of future.

I do always believe that more than being a teacher who teaches students subjects,...i rather want to be a teacher who wants to teach students how to love learning..

Subjects i handle :

Business studies

Management studies

Operations Management

Organisational Behaviour

Change Management

Research Methodology

Strategy Management

Economics

Human Resource Management

Performance Management

Training

International Business

Business Ethics

Business Communication

Things you can expect from me :

- A clear cut answer

- A detailed conceptual way of explanation

- Simplified answer form of complex topics

- Diagrams and examples filled answers

4.90+

46+ Reviews

54+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

MRI Company has one employee. FICA Social Security taxes are 6.2% of the first $106,800 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For MRI, its FUTA taxes are 0.8% and SUTA...

-

Mest Company has 9 employees. FICA Social Security taxes are 6.2% of the first $118,500 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are...

-

Mester Company has 10 employees. FICA Social Security taxes are 6.2% of the first $110,100 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.8% and SUTA taxes...

-

Implement two versions of the RESULT(s, a) function for the 8-puzzle: one that copies and edits the data structure for the parent node s and one that modifies the parent state directly (undoing the...

-

A sample of n = 40 is selected from a normal population with = 75 msec. and = 12, and a treatment is administered to the sample. The treatment is expected to increase scores by an average of 4...

-

Show that proposition 5.1 holds for asymmetric firms. Proposition 5.1 Proposition 5.1 Under the assumptions of the model, the introduction (or increase) of an emissions tax leads to: (a) a decrease...

-

Explain the role of interface in encapsulation. Provide examples.

-

Using the financial data shown in Exercise 2-17 for Polaris Realty Inc., prepare a retained earnings statement for the month ending November 30, 2011.

-

Journalize the following transactions for the A to Z Pool Supply, assuming the "net" method is used. Explanations are not required. a. Sold $64,000 of merchandise to Sonny's Spas, Inc., on account,...

-

Sampson Company uses a job order cost system with overhead applied to products based on direct labor hours. Based on previous history, the company estimated its total overhead for the coming year...

-

Merger Co. has 10 employees, each of whom earns $2,000 per month and has been employed since January 1. FICA Social Security taxes are 6.2% of the first $117,000 paid to each employee, and FICA...

-

Stark Company has five employees. Employees paid by the hour receive a $10 per hour pay rate for the regular 40-hour workweek plus one and one-half times the hourly rate for each overtime hour beyond...

-

Preparing a consolidated balance sheet. The first two columns of Exhibit 13.14 present information from the accounting records of Company P and Company S on December 31, 2009. Company P acquired l00%...

-

ELMI Corporation acquired a barn and three acres of land for a lump-sum price of $2,400,000. The barn contained used but fully-functional farming equipment. According to independent appraisals, the...

-

Use cross multiplication to solve the following proportion: 3x-7 2 = x+7 3

-

Simplify the expression. 2 x-25 10x+25

-

Mark received an excellent interest rate for her loan of $9,500. Calculate the nominal interest rate compounded semi-annually if the loan accumulated to $10,071.01 in 6 years and 6 months. % Round to...

-

Solve the following optimization problem (a) min = f(x, y) = 2x 2xy + y + 2x + y 5 I,YER - (b) min z = f(x, y) = 2x - 3xy + y+2x+y5 I,yR -

-

Solve each equation. |2x - 3| = |5x + 4|

-

Why is the national security argument for tariffs questionable?

-

Refer to information in Exercise 9-8. Compute profit margin and investment turnover for each department. Which department generates the most net income per dollar of sales? Which department is most...

-

MidCoast Airlines uses the following performance measures. Classify each of the performance measures below into the most likely balanced scorecard perspective it relates to. Label your answers using...

-

MidCoast Airlines uses the following performance measures. Classify each of the performance measures below into the most likely balanced scorecard perspective it relates to. Label your answers using...

-

Image transcription text Introduction: The Smart Parking Management System (SPMS) project aimed to develop an efficient, automated solution for managing parking spaces in urban areas using Arduino...

-

A. Can we use human capital theory to explain "Age-Discrimination"? If so, how? B. Why do some firms prefer to hire younger workers, especially for entry level positions? C. Why do some firms...

-

Image transcription text Question 6 Not yet answered Marked out of 1.00 '1" Flag question During a mountain?biking tripr Bill and Barry are discussing the merits of having the springs and shocks used...

Study smarter with the SolutionInn App