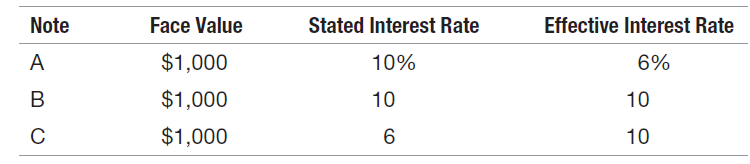

Consider the three notes payable listed here. Each was issued on January 1, 2018, and matures on

Question:

REQUIRED:

a. Compute the present value of the remaining cash outflows for each note at 1/1/18, 12/31/18 and 12/31/19.

b. Compute the balance sheet values of each note payable at each of the above dates, using the effective interest method.

c. Compute the balance sheet values of each note payable at each of the above dates, using the straight-line method (i.e., amortize an equal amount of the discount or premium each year).

d. Why is the effective interest method preferred to the straight-line method for financial reporting purposes?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: