During 2020, Point Addis Ltd commenced the construction of a windfarm for its own use. During the

Question:

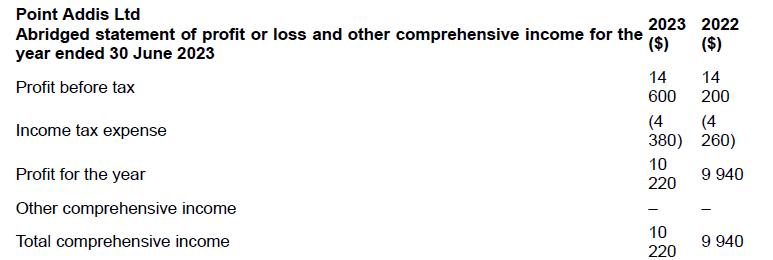

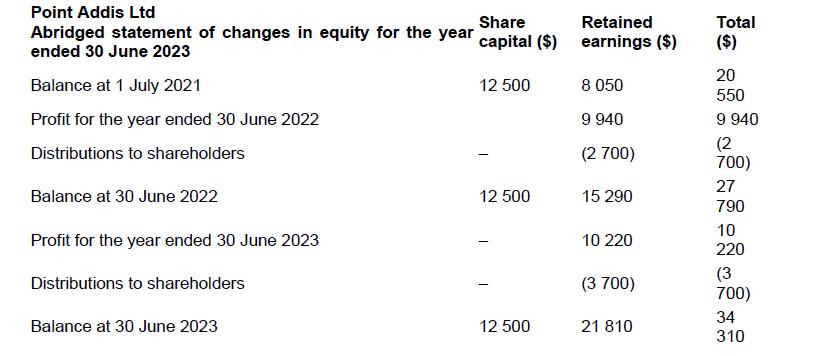

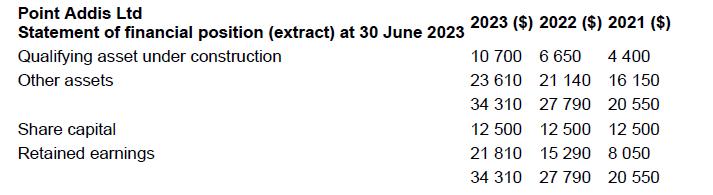

During 2020, Point Addis Ltd commenced the construction of a windfarm for its own use. During the reporting period ending 30 June 2023, a change in accounting standards means that the directors are required to change the company’s treatment of borrowing costs incurred in the construction of assets for its own use. In previous periods Point Addis Ltd expensed such costs, but must now capitalise them as part of the construction cost in line with the requirement of AASB 123. The unadjusted statement of profit or loss and other comprehensive income and statement of changes in equity for the reporting period ended 30 June 2023 are detailed below.

ADDITIONAL INFORMATION

1. In 2023, interest of $4000 relating to the construction of the windfarm was expensed. Interest costs of $3000 were expensed in 2022, $3900 was expensed in 2021 and $2200 was expensed in reporting periods prior to 2021.

2. No depreciation has been charged on the windfarm as it has not yet been commissioned.

3. The tax rate has remained at 30 per cent for the past three years.

REQUIRED

Redraft the statement of profit or loss and other comprehensive income, statement of changes in equity and statement of financial position (extract) so as to comply with generally accepted accounting practice and all relevant accounting standards.

Step by Step Answer: