Easley-O?Hara Office Equipment sells furniture and technology solutions to consumers and to businesses. Most consumers pay for

Question:

Easley-O?Hara Office Equipment sells furniture and technology solutions to consumers and to businesses. Most consumers pay for their purchases with credit cards and business customers make purchases on open account with terms 1/10, net 30. Costs of furniture inventory purchases have generally been rising and costs of computer inventory purchases have generally been declining. The company?s income tax rate is 20%.

Casey Easley, the general manager, was particularly interested in the financial statement effects of the following facts related to first quarter operations.

Credit card sales (discount 2%) were $30,000. Sales on account were $80,000. The company expects one-half of the accounts to be paid within the discount period.

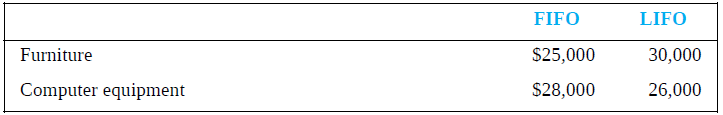

The company computed cost of goods sold for the transactions in (a) and (b) above under FIFO and LIFO for its two product lines and chose the method for each product that minimizes income taxes:

During the period, the company wrote off $1,000 worth of bad debts. At the end of the period, the company estimated that 1.5% of gross sales on account would prove to be uncollectible. Costs to deliver furniture to customers were $3,000. Rent, utilities, salaries, and other operating expenses were $20,000. At the end of the period, the company discovered that the net realizable value of ending inventory was $800 less than original cost.

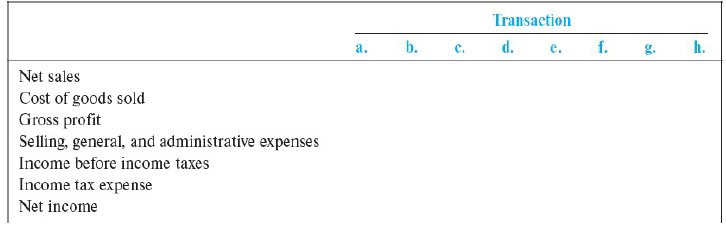

Required:

Complete the following table, indicating the effects of each transaction on each income statement line item or subtotal listed. Indicate the amount and use + for increase and ? for decrease; leave the space blank for no effect.

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Financial Accounting

ISBN: 978-1259964947

10th edition

Authors: Robert Libby, Patricia Libby, Frank Hodge