Gordon Company started operations on January 1 of the current year. It is now December 31, the

Question:

Gordon Company started operations on January 1 of the current year. It is now December 31, the end of the current annual accounting period. The part-time bookkeeper needs your help to analyze the following three transactions:

a. During the year, the company purchased office supplies that cost $3,000. At the end of the year, office supplies of $800 remained on hand.

b. On January 1 of the current year, the company purchased a special machine for cash at a cost of $25,000. The machine’s cost is estimated to depreciate at $2,500 per year.

c. On July 1, the company paid cash of $1,000 for a two-year premium on an insurance policy on the machine; coverage began on July 1 of the current year.

Required:

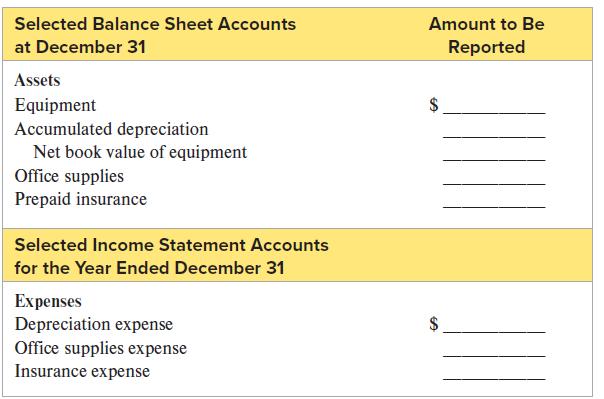

Complete the following schedule with the amounts that should be reported for the current year:

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge