Hexaware Technologies Limited is a leading software services provider, specializing in Application Management, EAI, e-Commerce, ERP and

Question:

Hexaware Technologies Limited is a leading software services provider, specializing in Application Management, EAI, e-Commerce, ERP and Embedded Systems. Industries served by the company include Airlines, Banking and Financial Services, Insurance and Healthcare.

Following are excerpts from their Annual Report of December 2003. These relate to a change in depreciation policy and practices adopted by the company:

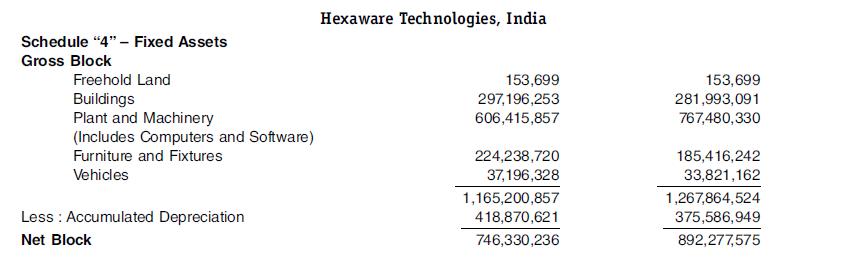

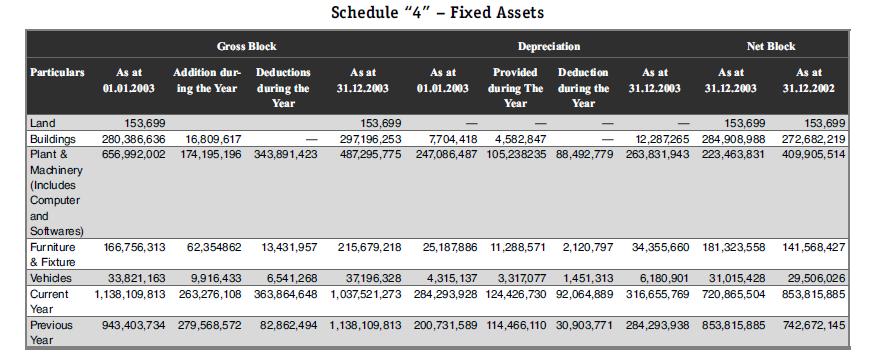

Relevant Observation on Fixed Assets mentioned in the management discussion:

- Net Fixed assets decreased by 16 percent from ₹892.39 million in 2002 to ₹746.33 million in 2003. This was mainly due to investments in infrastructure of ₹279.40 million and a provision of ₹239.31 million for impairment of fixed assets. The Company has also accelerated its depreciation for computers and software from the earlier 3-5 years to 3 years resulting in the reduction in net fixed assets.

Relevant Explanations on Fixed Assets and Depreciation in the schedule:

- Fixed Assets are stated at cost of acquisition less accumulated depreciation. Cost includes all expenses incurred for acquisition of assets like inward freight, duties, taxes, etc.

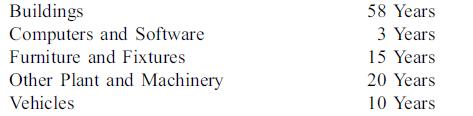

- Depreciation of fixed assets is provided on straight line method over the useful life of assets, as estimated by the management as stated under on a pro-rata basis, or as per Schedule XIV of the Companies Act, 1956 in cases where the rates specified therein are higher.

Relevant Notes on Fixed Assets and Depreciation in the Notes to accounts:

- During the year the Company has reduced the estimated useful life for Computers Systems and Software included in Plant and Machinery from 3-5 years to 3 years, consequently, the provision for depreciation for the year is higher by ₹34,580,414 and correspondingly the net profit, reserves and surplus and net fixed assets are lower by ₹34,580,414.

- During the year 2003, the Company has adopted Accounting Standard 28 issued by the Institute of Chartered Accountants of India and accordingly it has provided for impairment of fixed assets against General Reserve, amounting to ₹239,306,706.

Case Questions

(a) Please list out the possible journal entries the company may have had to note the above changes?

(b) You are required to analyze the impact of the changes on the company’s financial statements and comment on the same?

(c) As per Ind-AS, did the company comply with the same? Did it provide enough information to the readers of annual reports? Discuss.

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani