Lisa Knight owns and operates Lisas Day Spa and Salon, Inc. She has decided to sell the

Question:

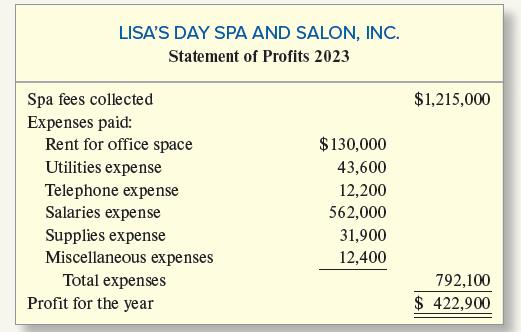

Lisa Knight owns and operates Lisa’s Day Spa and Salon, Inc. She has decided to sell the business and retire, and is in discussions with Helen Bailey, the owner of a regional chain of day spas. The discussions are at the complex stage of agreeing on a price. Among the important factors have been the financial statements of the business. Lisa’s secretary, Alisha, under Lisa’s direction, maintained the records. Each year they developed a statement of profits on a cash basis; no balance sheet was prepared. Upon request, Lisa provided the Helen with the following statement for 2023 prepared by Alisha:

Upon agreement of the parties, you have been asked to examine the financial figures for 2023. Helen said, “I question the figures because, among other things, they appear to be on a 100 percent cash basis.” Your investigations revealed the following additional data at December 31, 2023:

a. Of the $1,215,000 in spa fees collected in 2023, $142,000 was for services performed prior to 2023.

b. At the end of 2023, spa fees of $29,000 for services performed during the year were uncollected.

c. Office equipment owned and used by Lisa cost $205,000. Depreciation was estimated at $20,500 annually.

d. A count of supplies at December 31, 2023, reflected $5,200 worth of items purchased during the year that were still on hand. Also, the records for 2022 indicated that the supplies on hand at the end of that year were $3,125.

e. At the end of 2023, the secretary whose salary is $24,000 per year had not been paid for December because of a long trip that extended to January 15, 2024.

f. The December 2023 telephone bill for $1,400 has not been recorded or paid. In addition, the $12,200 amount on the statement of profits includes payment of the December 2022 bill of $1,800 in January 2023.

g. The $130,000 office rent paid was for 13 months (it included the rent for January 2024).

Required:

1. On the basis of this information, prepare a corrected income statement for 2023 (ignore income taxes). Show your computations for any amounts changed from those in the statement prepared by Lisa’s secretary. (Suggestion: Format solution with four column headings: Items; Cash Basis per Lisa’s Statement, $; Explanation of Changes; and Corrected Basis, $.)

2. Write a memo to Lisa Knight and Helen Bailey to support your schedule prepared in requirement (1). The purpose should be to explain the reasons for your changes and to suggest other important items that should be considered in the pricing decision.

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge