Mr. Singh, having completed diploma course in driving, started his career as business development executive with Lucky

Question:

Mr. Singh, having completed diploma course in driving, started his career as business development executive with Lucky Car Hire Services. The company provided personal transport service to corporate clients. While performing his job, Mr Singh developed good liaison with major clients, such as ITC, SHCIL and BPL. On one occasion, he had heated arguments with his immediate boss and just next day he resigned from the job. As business development executive, Mr Singh used to draw a salary or ₹4,50,000 per annum. Having a good experience of managing car hire services and good liaison with corporate clients, he started his own car hire agency in the name of Lovely Car Hire Services.

Lovely Car Hire Agency—The Beginning

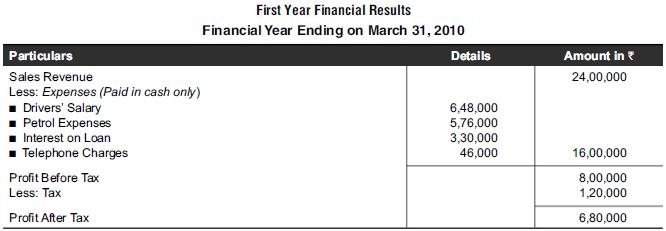

The agency was started by taking a loan from Bank of ₹33,00,000 @ 10% p.a. With this, Mr Singh purchased six taxies costing ₹5,00,000 and he kept ₹3,00,000 for working capital purpose. Initially, he managed all his business affairs from his residence and hired sufficient number of drivers and one office assistant. On account of his good liaison with corporate clients, he could manage good amount of business during the year. The financial transactions for the first year were as follows:

■ All the six taxies were hired out to six corporate clients at a monthly rent of ₹4,00,000 per annum per car.

■ Six drivers were hired at a consolidated pay package of ₹9,000 per month per driver.

■ During the year, he paid in cash an average petrol expense of ₹8,000 per month per car.

■ At the end of the year, ₹16,000 was yet to be paid for petrol expenses.

■ Being the first year of operations, the cars did not require any repairs and maintenance.

■ Average lifespan of each car was estimated at five years with 10% salvage value at the end.

■ As per the scheme of Government, he was required to pay only 15% on the net profit earned for the year by him.

■ At the end of the year, he was assured of continuing at the same pace in the years to come also.

Out of the profits he used ₹2,40,000 per annum for his household expenses and rest of the amount, he maintained in a bank account to be used to repay the bank loan at the end. He was optimistic of continuing the business at a higher scale in the years to come.

1. Evaluate the financial statement prepared by Mr Singh.

2. Comment on the accounting policy adopted by Mr Singh.

3. Suggest an appropriate accounting course of action for Mr Singh.

Step by Step Answer: