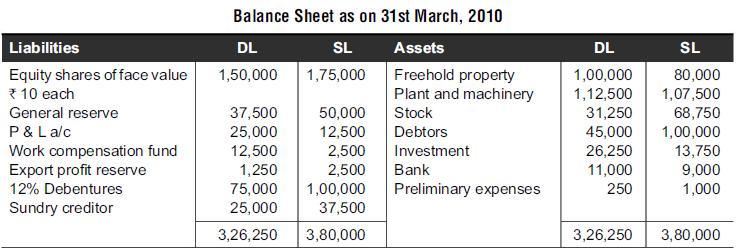

On 1st April, 2010, Dubar Limited acquired the assets and liabilities of Super Limited. Dubar and Super

Question:

On 1st April, 2010, Dubar Limited acquired the assets and liabilities of Super Limited.

Dubar and Super agreed for the following scheme of business acquisition:

(i) Dubar not to take investment of Super.

(ii) Freehold property of Super to be valued at ₹1,70,000 and stock at ₹60,000.

(iii) Stock of Dubar comprises of stock worth 15,000 (cost to super ₹12,000) purchased from Super.

(iv) Debtors of Dubar include ₹7,000 due from Super.

(iv) Dubar to issue its equity shares of face value ₹10 in such number which is calculated using a swap ratio of 3 : 5 for Super. Each share so issued has a fair value ₹14 on the date of acquisition.

(v) Statutory reserves need not to be carried for future.

Show post acquisition balance sheet of Dubar.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: