Party Wagon, Inc., provides musical entertainment at weddings, dances, and various other functions. The company performs adjusting

Question:

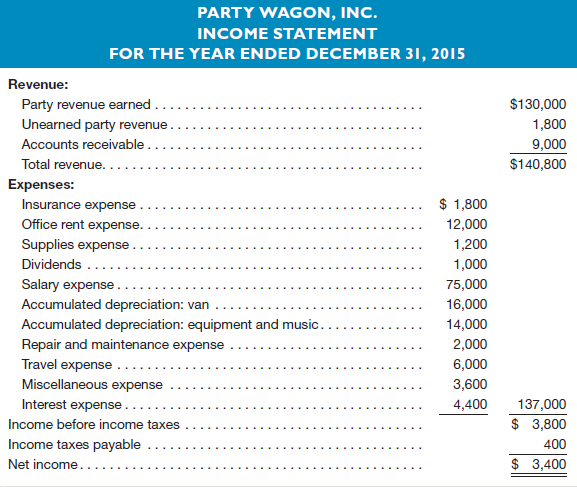

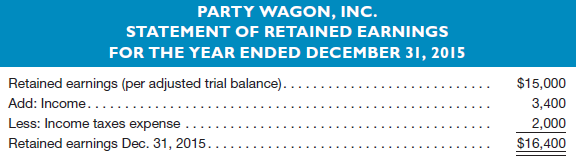

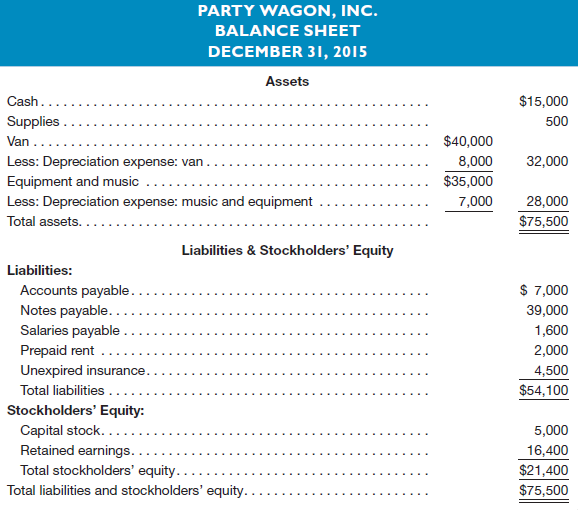

Party Wagon, Inc., provides musical entertainment at weddings, dances, and various other functions. The company performs adjusting entries monthly, but prepares closing entries annually on December 31. The company recently hired Jack Armstrong as its new accountant. Jack’s first assignment was to prepare an income statement, a statement of retained earnings, and a balance sheet using an adjusted trial balance given to him by his predecessor, dated December 31, 2015. From the adjusted trial balance, Jack prepared the following set of financial statements:

Instructions

a. Prepare a corrected set of financial statements dated December 31, 2015. (You may assume that all of the figures in the company’s adjusted trial balance were reported correctly except for Interest Payable of $200, which was mistakenly omitted in the financial statements prepared by Jack.)

b. Prepare the necessary year-end closing entries.

c. Using the financial statements prepared in part a, briefly evaluate the company’s profitability and liquidity.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Accounting

ISBN: 978-0077862381

16th edition

Authors: Jan Williams, Susan Haka, Mark S Bettner, Joseph V Carcello