Pickering Financial Management believes that the biotechnology industry is a good investment and is considering investing in

Question:

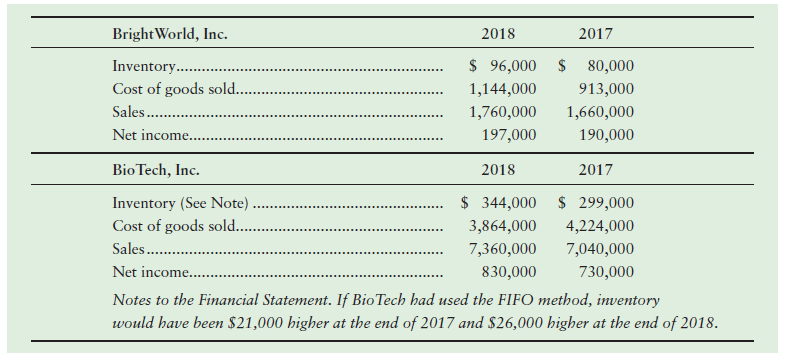

Pickering Financial Management believes that the biotechnology industry is a good investment and is considering investing in one of two companies. However, one company, BrightWorld, Inc., uses the FIFO method of inventory, and another company, BioTech, Inc., uses LIFO. Because the companies use two different methods and because Bio- Tech is a much larger company, it is difficult to compare their net incomes to see which is a better investment. The following information about the two companies is available from their annual reports:

To better compare the two companies, Pickering wants you to prepare the following analysis.

Requirements

1. Show the computation of BioTech’s cost of goods sold in 2018 using the LIFO method. Refer to Appendix 6B for an illustration.

2. Prepare summary journal entries for 2018 for BioTech’s purchases of inventory (assume all purchases are on account), sales (assume all are on account), and cost of goods sold. Prepare a T-account for inventory and post these transactions into the T-account. The company uses the perpetual inventory method.

3. Show the computation of BioTech’s cost of goods sold for 2018 using the FIFO method.

4. Compute the gross profit percentage for 2018 for both BrightWorld and BioTech using FIFO figures for both.

5. Compute the inventory turnover for 2018 for both BrightWorld and BioTech using FIFO figures for both.

6. Which company appears stronger? Support your answer.

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.