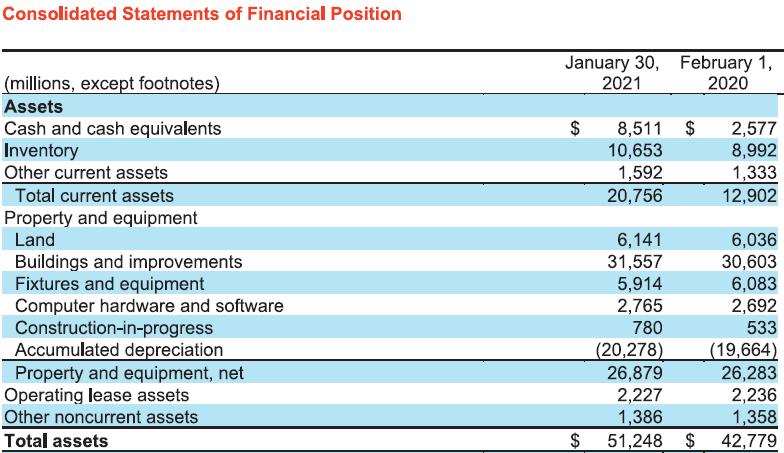

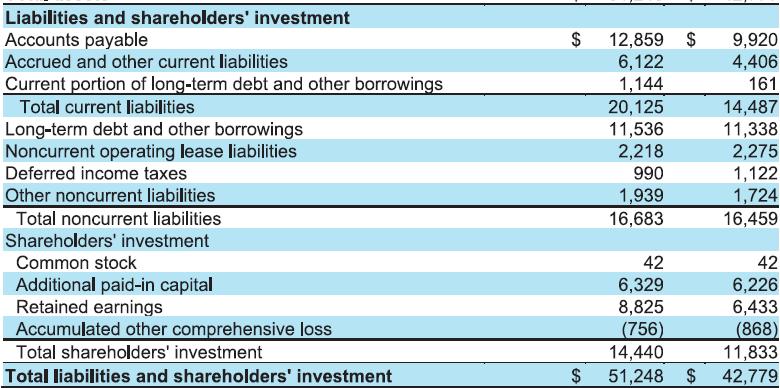

Refer to the financial statements of Target given in Appendix B at the end of this book.

Question:

Refer to the financial statements of Target given in Appendix B at the end of this book.

Data from in Appendix B

Required:

1. What does the company include in its category of cash and cash equivalents? How close do you think the disclosed amount is to actual fair market value?

a. All assets with a fair value measurement.

b. Highly liquid investments with an original maturity of three months or less from the time of purchase.

c. Cash and accounts receivable (net).

d. Cash and bank overdrafts.

e. None of the above.

2. What expenses does Target subtract from Total revenue (net sales) in the computation of Operating income? (Select all that apply.)

a. Cost of sales

b. Selling, General, and administrative expenses

c. Net interest expense

d. Provision for income taxes

e. Depreciation and amortization

3. Compute Target’s receivables turnover ratio for the current year using the “Total revenue” for net sales and the account “Accounts and other receivables.” Round your answer to the nearest whole number.________________________

4. What characteristic of its business is the main cause Target’s receivables turnover ratio is so high?

a. Its net profit margin is very high.

b. Most of its sales are for cash or credit cards such as Visa and Mastercard.

c. It sells a wide variety of merchandise and food.

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge