RUV commenced operations on 1 June 2019 selling one type of shirt. The company uses FIFO (first

Question:

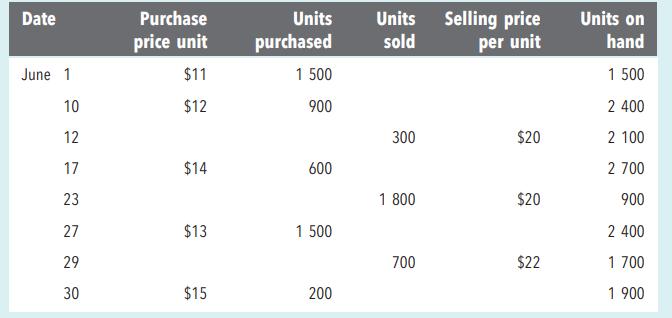

RUV commenced operations on 1 June 2019 selling one type of shirt. The company uses FIFO (first in, first out) and perpetual inventory control. The June inventory and sales records for the shirts were as follows:

1. Calculate COGS for the month ended 30 June 2019.

2. Calculate the cost of ending inventory as at 30 June 2019.

3. Calculate gross profit for the month ended 30 June 2019.

4. Assume that on 30 June, a total of 400 units (not 200 units) were purchased for $17 each.

Calculate the change in gross profit for the month ended 30 June 2019, based on this assumption.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Integrated Approach

ISBN: 9780170411028

7th Edition

Authors: Ken Trotman, Elizabeth Carson

Question Posted: