Shalini Beck was an ideal mother-in-law! Both, at work and at home. Her firm, Shalini Pesticides was

Question:

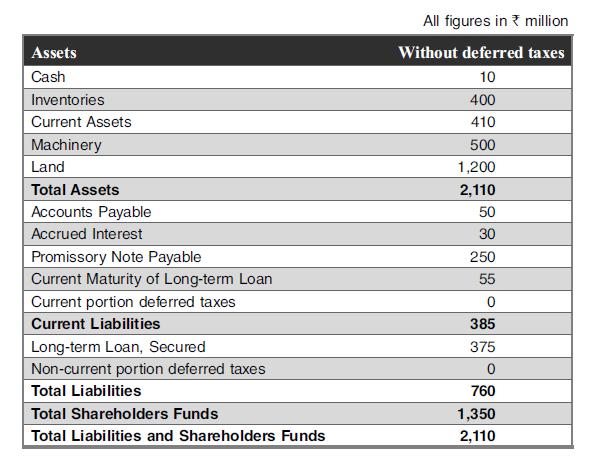

Shalini Beck was an ideal mother-in-law! Both, at work and at home. Her firm, Shalini Pesticides was doing fine. The following table contains the numbers of Shalini Pesticides. They are computed without deferred taxes, which are estimated to have an average tax rate of about 35%. It is known that these deferred taxes are resultant from two activities for Shalini Pesticide. First, taxes due upon the sale of inventories and other assets that are part of ongoing acitivities wherein ₹100,000 of pesticides would yield ₹100,000 of taxable income. Second, taxes due upon the sale of capital assets sold at the value indicated as ₹1,700,000,000 on the balance sheet, whereas, it is known that the tax-basis value of these is ₹750,000,000.

You are required to:

(a) Compute the table with deferred taxes;

(b) How much is the difference in total shareholders’ funds between earlier balance sheet and the new balance sheet created by you;

(c) For good ‘financial reporting practice’ which one of the financial statement you would agree with? How will you present the same with traditional stakeholders who are unwilling to change?

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani