South Bend Repair Service Co. keeps its records without the help of an accountant. After much effort,

Question:

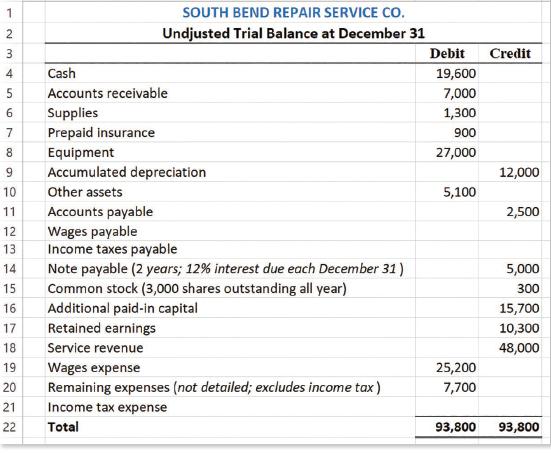

South Bend Repair Service Co. keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on December 31:

Data not yet recorded at December 31 of the current year include

a. Depreciation expense for the current year, $3,000.

b. Insurance expired during the current year, $450.

c. Wages earned by employees but not yet paid on December 31 of the current year, $2,100.

d. The supplies count at the end of the current year reflected $800 in remaining supplies on hand to be used in the next year.

e. Seven months of interest expense (on the note payable borrowed on June 1 of the current year) was incurred in the current year.

f. Income tax expense was $1,914.

Required:

1. Record the adjusting entries.

2. Prepare an income statement (with Operating Income and Other Items sections, and earnings per share) and a classified balance sheet for the current year to include the effects of the preceding six transactions. Round earnings per share to the nearest penny.

3. Record the closing entry.

Step by Step Answer:

Financial Accounting

ISBN: 9781264229734

11th Edition

Authors: Robert Libby, Patricia Libby, Frank Hodge