Suppose a Target store in Chicago, Illinois, ended November 2018 with 500,000 units of merchandise that cost

Question:

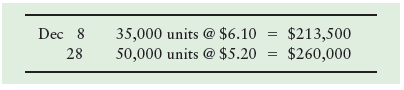

Suppose a Target store in Chicago, Illinois, ended November 2018 with 500,000 units of merchandise that cost $8.00 each. Suppose the store then sold 110,000 units for $960,000 during December. Further, assume the store made two large purchases during December as follows:

Requirements

1. Calculate the store’s gross profit under FIFO and LIFO at December 31.

2. What caused the FIFO and LIFO gross profit figures to differ?

Transcribed Image Text:

35,000 units @ $6.10 50,000 units @ $5.20 $213,500 $260,000 Dec 8 28

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 58% (12 reviews)

Req 1 Gross profit FIFO LIFO Sales revenue 960000 960000 C...View the full answer

Answered By

Hemstone Ouma

"Hi there! My name is Hemstone Ouma and I am a computer scientist with a strong background in hands-on experience skills such as programming, sofware development and testing to name just a few. I have a degree in computer science from Dedan Kimathi University of Technology and a Masters degree from the University of Nairobi in Business Education. I have spent the past 6 years working in the field, gaining a wide range of skills and knowledge. In my current role as a programmer, I have had the opportunity to work on a variety of projects and have developed a strong understanding of several programming languages such as python, java, C++, C# and Javascript.

In addition to my professional experience, I also have a passion for teaching and helping others to learn. I have experience as a tutor, both in a formal setting and on a one-on-one basis, and have a proven track record of helping students to succeed. I believe that with the right guidance and support, anyone can learn and excel in computer science.

I am excited to bring my skills and experience to a new opportunity and am always looking for ways to make an impact and grow as a professional. I am confident that my hands-on experience as a computer scientist and tutor make me a strong candidate for any role and I am excited to see where my career will take me next.

5.00+

8+ Reviews

22+ Question Solved

Related Book For

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Question Posted:

Students also viewed these Business questions

-

Jones, having filed locally an affidavit required under the assumed name statute, has been operating and advertising his exclusive toy store for twenty years in Centerville, Illinois. His advertising...

-

The Malabar Company specializes in imported novelty items from Asian countries such as Thailand, Indonesia, and China. The firm, headquartered in San Jose, California, has franchised over 70 stores...

-

Sally, having filed locally an affidavit required under the assumed name statute, has been operating and advertising her exclusive toy store for twenty years in Centerville, Illinois. Her advertising...

-

(1.71, 2.05) Use the confidence interval to find the margin of error and the sample mean.

-

(a) Find the one-parameter group of rotations generated by the skew-symmetric matrix (b) As noted above, etA represents a family of rotations around a fixed axis in R3. What is the axis? 011

-

a. In general, do you trust our government in Washington, D.C.? Explain. b. More specifically, do you trust the federal agencies we have been discussing in this chapter, including, for example, the...

-

What is the default filename that make will process if no other is given?

-

You have completed the field work in connection with your audit of Alexander Corporation for the year ended December 31, 2012. The balance sheet accounts at the beginning and end of the year are...

-

Create a table in excel showing net present value calculation for the following scenario. You will have a column with time period, future value, and present value included. You can anticipate that...

-

Trafflet Enterprises incorporated on May 3, 2011. The company engaged in the following transactions during its first month of operations: May 3 Issued capital stock in exchange for $800,000 cash. May...

-

Paulsons specializes in sound equipment. Company records indicate the following data for a line of speakers: Requirements 1. Determine the amounts that Paulsons should report for cost of goods sold...

-

Huron Garden Supplies uses a perpetual inventory system. The company has these account balances at October 31, 2018, prior to making the year-end adjustments: A year ago, the net realizable value of...

-

The two blocks shown in FIGURE 8-43 are moving with an initial speed v. (a) If the system is frictionless, find the distance d the blocks travel before coming to rest. (Let U = 0 correspond to the...

-

For this assignment you will implement a number of Boolean functions, such as implies, nand, etc. In this assignment you will implement several Boolean functions that will later enable you to compute...

-

Suppose you wanted to purchase a Christmas Ornament Zip Chest. The original price is $50.00. They are on sale for 50% off the original price. You have a coupon for an extra 15% off the sale price. a....

-

The Fourth Amendment protects individuals from unreasonable searches and seizures and requires two branches of government to agree in order for search warrants to be issued. But what happens when the...

-

Osborne Company acquired three machines in a package deal for an amount less than the combined fair value of the assets. How should Osborne record the cost of the assets on its books?

-

Under the Fair Value through Net Income Method, what events must be recorded when the equity investment is sold?

-

There is an increase in availability of alternative fuels through research and development. Which of the following correctly captures the effect of this change on the market for gasoline? A. Both...

-

A police officer pulls you over and asks to search your vehicle because he suspects you have illegal drugs inside your car. Since he doesn't have reasonable suspicion to search your car, legally he...

-

State whether each of the following statements is true or false. _____1. Convertible bonds are also known as callable bonds. _____2. The market rate is the rate investors demand for loaning funds....

-

State whether each of the following statements is true or false. _____1. Convertible bonds are also known as callable bonds. _____2. The market rate is the rate investors demand for loaning funds....

-

Grenke Corporation issues $300,000 of bonds for $315,000. (a) Prepare the journal entry to record the issuance of the bonds, and (b) Show how the bonds would be reported on the balance sheet at the...

-

A bond has a coupon rate of 1 0 . 5 % and pays coupons annually. The bond matures in 9 years and the yield to maturity on similar bonds is 9 . 4 % . What is the price of the bond?

-

A 1 5 - year, 1 4 % semiannual coupon bond with a par value of $ 1 , 0 0 0 may be called in 4 years at a call price of $ 1 , 0 7 5 . The bond sells for $ 1 , 0 5 0 . ( Assume that the bond has just...

-

A particle has its position as a function of time given by; (t) = 3.33m cos (0.95t+0.58) + 3.33m sin(0.95-t + 0.58) +5.82tk (The input below will accept answers with no more than 1% variation from...

Study smarter with the SolutionInn App