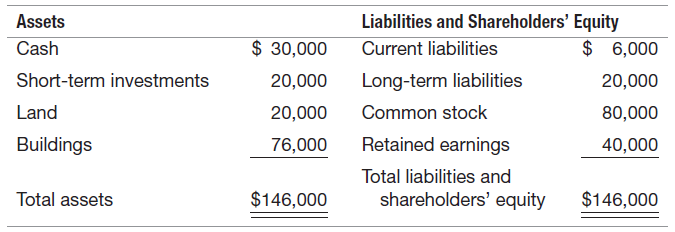

Suppose that Myers and Myers in P38 paid no dividends during 2018 and that the December 31,

Question:

Assume that the investor in P3€“8 was correct (i.e., the company produced $20,000 cash during 2018) and that the investor€™s expectations at the end of 2018 are unchanged. Assume further that an objective appraisal of the company€™s assets revealed the following FMVs as of December 31, 2018:

Cash ...............................................................$ 30,000

Short-term investments .................................20,000

Land ..................................................................66,000

Buildings ..........................................................32,000

Total FMVs ...................................................$148,000

REQUIRED:

a. What dollar amount did Myers and Myers report in 2018 for net income under generally accepted accounting principles?

b. Calculate net income during 2018, using fair market values as the asset and liability valuation bases (i.e., FMV2018 ˆ’ FMV2017).

c. Calculate economic income for 2018 (i.e., cash received during 2018 plus the change in present value). The discount rate is still 10 percent.

d. Discuss the differences among these three measures of income. Discuss some of the strengths and weaknesses of each measure.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer: