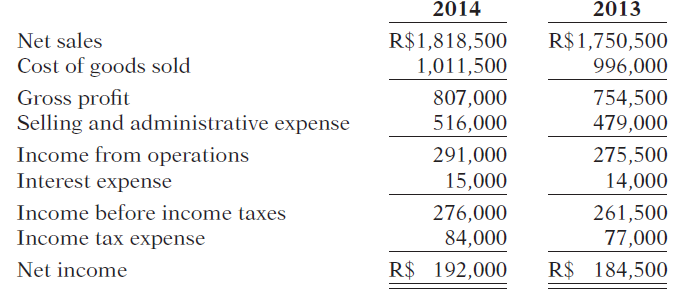

The comparative statements of Larker Tool Company are presented below. Larker Tool Company Income Statement For the

Question:

Larker Tool Company

Income Statement

For the Years Ended December 31

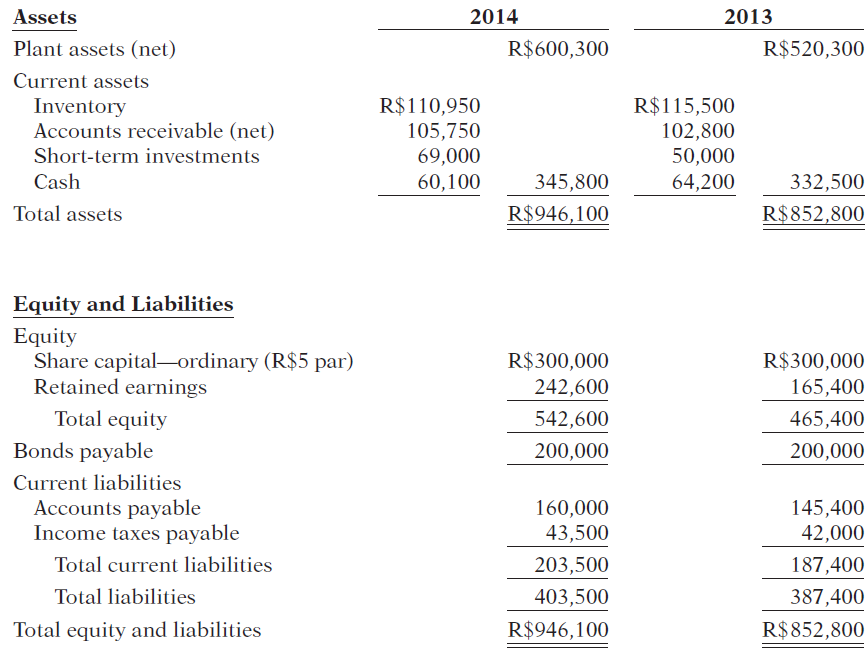

Larker Tool Company

Statements of Financial Position

December 31

All sales were on account.

Instructions

Compute the following ratios for 2014. (Weighted-average ordinary shares in 2014 were 60,000.)

(a) Earnings per share.

(b) Return on ordinary shareholders€™ equity.

(c) Return on assets.

(d) Current.

(e) Acid-test.

(f) Accounts receivable turnover.

(g) Inventory turnover.

(h) Times interest earned.

(i) Asset turnover.

(j) Debt to total assets.

Transcribed Image Text:

2014 2013 R$1,818,500 1,011,500 Net sales R$1,750,500 996,000 Cost of goods sold Gross profit Selling and administrative expense 807,000 516,000 754,500 479,000 Income from operations 291,000 275,500 14,000 Interest expense 15,000 Income before income taxes 276,000 84,000 261,500 77,000 Income tax expense R$ 184,500 R$ 192,000 Net income Assets 2014 2013 Plant assets (net) R$600,300 R$520,300 Current assets R$115,500 Inventory Accounts receivable (net) R$110,950 105,750 69,000 102,800 50,000 Short-term investments Cash 60,100 345,800 64,200 332,500 Total assets R$946,100 R$852,800 Equity and Liabilities Equity Share capital-ordinary (R$5 par) Retained earnings R$300,000 R$300,000 165,400 242,600 Total equity 542,600 465,400 Bonds payable 200,000 200,000 Current liabilities Accounts payable Income taxes payable 160,000 145,400 42,000 43,500 Total current liabilities 203,500 187,400 Total liabilities 403,500 387,400 Total equity and liabilities R$946,100 R$ 852,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

a Earnings per share b Return on ordinary shareholders equity c Re...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Financial Accounting IFRS

ISBN: 978-1118285909

2nd edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted:

Students also viewed these Business questions

-

The comparative statements of Larker Tool Company are presented below. All sales were on account. Instructions Compute the following ratios for 2014. (Weighted-average common shares in 2014 were...

-

The comparative statements of Larker Tool Company are presented below. All sales were on account. Instructions Compute the following ratios for 2013. (Weighted-average common shares in 2013 were...

-

The comparative statements of Larker Tool SA are presented below. LARKER TOOL SA Income Statement For the Years Ended December 31 LARKER TOOL SA Statements of Financial Position December 31 All sales...

-

A nutritionally defective E. coli strain grows only on a medium containing thymine, whereas another nutritionally defective strain grows only on a medium containing leucine. When these two strains...

-

What are the major responsibilities of the Securities and Exchange Commission?

-

A woman and her dog are out for a morning run to the river, which is located 4.0 km away. The woman runs at 2.5 m/s in a straight line. The dog is unleashed and runs back and forth at 4.5 m/s between...

-

Given the formulation of the free boundary problem for the valuation of an American Put option, \[\begin{aligned}& \frac{\partial P}{\partial t}+\frac{1}{2} \sigma^{2} S^{2} \frac{\partial^{2}...

-

1. How should Captain Jones begin the process of preparing a new budget? 2. Assuming that the Greenfield officers are still relying on preventive patrol, how could a change in strategy benefit the...

-

2. Let's say the Ford bond above is secured by collateral, does not have a sinking fund, is callable, and does not have protective covenants. The GM bond is secured by collateral, has a sinking fund,...

-

Marigold Company purchased equipment on January 1, 2018 at a total invoice cost of $341000 additional costs of $7000 for freight and $25000 for installation were incurred The equipment has an...

-

Condensed statement of financial position and income statement data for Clarence Corporation appear below. Clarence Corporation Statements of Financial Position December 31 Clarence Corporation...

-

Comparative statement data for Lionel Company and Barrymore Company, two competitors, appear below. All statement of financial position data are as of December 31, 2014, and December 31, 2013....

-

What is the biggest disadvantage of using ROI to evaluate investment centers?

-

Mr. John Estes oversees the distribution of Tastee Snacks products from the plant warehouse to its two distribution centers in the United States. The plant warehouse currently has 47,000 units | of...

-

Payroll is where most of the fraudulent activity occurs in businesses. Accountants use Segregation of Duties to safeguard company assets. REQUIRED: Research Segregation of Duties and prepare a Memo...

-

Assume that Jones Company made a payment on a mortgage. It included $100 of principal and $150 of interest. What would the journal entry be to record the payment?

-

George and Wanda received $30,200 of Social Security benefits this year ($12,000 for George; $18,200 for Wanda). They also received $5,000 of interest from jointly owned City of Ranburne Bonds and...

-

Jim has an outstanding credit card balance of $5,000 carrying an APR finance rate of 25.0% (note interest will be compounded monthly) and requiring minimum monthly payments of $200 per month -If only...

-

Which of the following DML operations cant be performed on a view containing a group function? a. INSERT b. UPDATE c. DELETE d. All of the above can be performed on a view containing a group...

-

To help you become familiar with the accounting standards, this case is designed to take you to the FASBs Web site and have you access various publications. Access the FASBs Web site at...

-

On August 1, Paul Company buys 1,000 shares of Merlynn common stock for $35,000 cash, plus brokerage fees of $700. On December 1, Paul sells the stock investments for $40,000 in cash. Journalize the...

-

Texas Company owns 25% of Plano Company. For the current year, Plano reports net income of $180,000 and declares and pays a $50,000 cash dividend. Record Texass equity in Planos net income and the...

-

Gurnee Corporation has the following long-term investments: (1) Common stock of Kornas Co. (10% ownership) held as available-for-sale securities, cost $108,000, fair value $115,000. (2) Common stock...

-

1. Mention five key organizational characteristics that the Cll research team identified for organizations with effective quality management systems. provide brief discussion of each and how it...

-

When a metal was exposed to photons at a frequency of 1.46 1015 s1, electrons were emitted with a maximum kinetic energy 3.60 10-19 J. G ? Calculate the work function, , of this metal. J/photon What...

-

No. 101 Debit Cash $ 2,400 Question 2 (10 pts) On November 1, 2024, the account balances of Schilling Equipment Repair were as follows. Accumulated Depreciation-Equipment A Clipboard Font Alignment...

Study smarter with the SolutionInn App