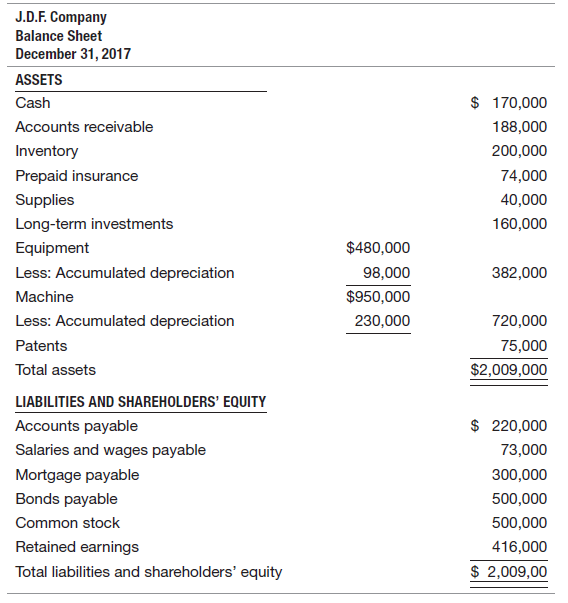

The following balance sheet is presented for J.D.F. Company as of December 31, 2017. During 2018, J.D.F.

Question:

During 2018, J.D.F. entered into the following transactions.

1. Made credit sales of $1,350,000 and cash sales of $350,000. The cost of the inventory sold was $700,000.

2. Purchased $820,000 of merchandise inventory on account.

3. Made cash payments of $400,000 to employees for salaries. This amount includes the wages due employees as of December 31, 2017.

4. Purchased $110,000 of supplies inventory by issuing a six-month note that matures on March 12, 2019.

5. Collected $850,000 from customers in payment of open accounts receivable.

6. Paid suppliers $870,000 for payment of open accounts payable.

7. Sold a long-term investment for $37,000. The stock had been purchased for $30,000.

8. Paid $148,000 in cash for other operating expenses.

9. Issued additional common stock for $120,000 cash.

10. On September 30, 2018, a customer gave the company a note due on May 1, 2019, in payment of a $72,000 account receivable.

11. The company declared and paid a cash dividend of $50,000.

12. The company purchased stock in Microsoft as a long-term investment for $50,000.

J.D.F. used the following information to prepare adjusting journal entries on December 31, 2018.

(a) 40 percent of the prepaid insurance on January 1 was still in effect as of December 31, 2018.

(b) A physical count of the supplies inventory indicated that the company had $40,000 on hand as of December 31, 2018.

(c) A review of the company€™s advertising campaign indicates that of the expenditures made during 2018 for other operating expenses, $25,000 applies to promotions to be undertaken during 2019.

(d) The company is charged at a rate of $3,500 per month for certain legal expenses. It paid $36,000 for these expenses during the year, which are part of other operating expenses and must now be reclassified as legal expense.

(e) The company owes employees $43,000 for wages as of December 31, 2018.

(f) The $72,000 note receivable accepted in payment of an account receivable (see [10] above) specifies an annual interest rate of 9 percent.

(g) Equipment has an estimated useful life of 10 years, and machinery has an estimated useful life of 20 years. The patent originally cost $125,000 and had an estimated useful life of 10 years. The company uses the straight-line method to depreciate and amortize all property, plant, equipment, and intangibles.

(h) The note issued by the company (see [4] above) has a stated rate of 10 percent and was issued on September 12, 2018.

REQUIRED:

a. Prepare the journal entries.

b. Prepare the t-accounts.

c. Prepare the worksheet.

d. Prepare the adjusting entries.

e. Prepare the closing entries.

f. Prepare an income statement, a statement of shareholders€™ equity, a balance sheet, and a statement of cash flows using the direct form of presentation.

g. Prepare the operating section of the statement of cash flows under the indirect method.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: