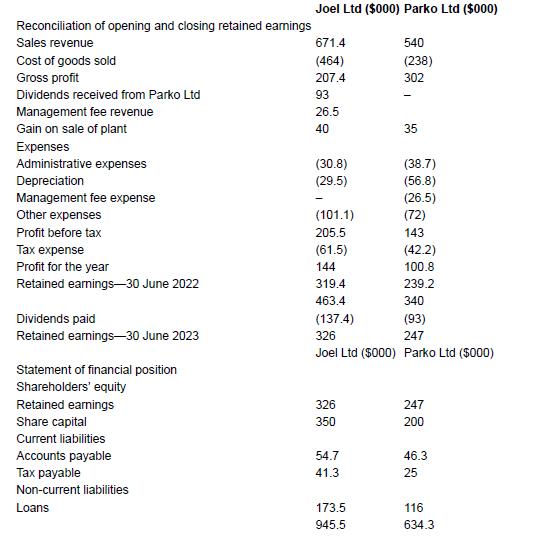

The following financial statements of Joel Ltd and its subsidiary Parko Ltd have been extracted from their

Question:

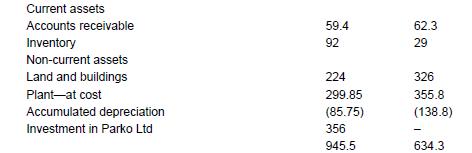

The following financial statements of Joel Ltd and its subsidiary Parko Ltd have been extracted from their financial records at 30 June 2023.

Page 1053Other information

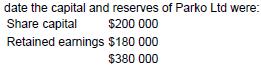

Joel Ltd acquired its 100 per cent interest in Parko Ltd on 1 July 2018, that is, five years earlier. At that

- At the date of acquisition all assets were considered to be fairly valued.

- During the year Joel Ltd made total sales to Parko Ltd of $60 000, while Parko Ltd sold $50 000 in inventory to Joel Ltd.

- The opening inventory in Joel Ltd as at 1 July 2022 included inventory acquired from Parko Ltd for $40000 that cost Parko Ltd $30 000 to produce.

- The closing inventory in Joel Ltd includes inventory acquired from Parko Ltd at a cost of $33 000. This cost Parko Ltd $28 000 to produce.

- The closing inventory of Parko Ltd includes inventory acquired from Joel Ltd at a cost of $12 000. This cost Joel Ltd $10 000 to produce.

- On 1 July 2022 Parko Ltd sold an item of plant to Joel Ltd for $116 000 when its carrying value in Parko Ltd’s accounts was $81 000 (cost $135 000, accumulated depreciation $54 000). This plant is assessed as having a remaining useful life of six years. The Group has a policy of measuring its property, plant and equipment using the ‘cost model’. The group uses the straight-line method of depreciation.

- Parko Ltd paid $26 500 in management fees to Joel Ltd.

- The tax rate is 30 per cent.

REQUIRED

Prepare a consolidated statement of financial position, a consolidated statement of profit or loss and other comprehensive income and a consolidated statement of changes in equity for Joel Ltd and Parko Ltd as at 30 June 2023.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: