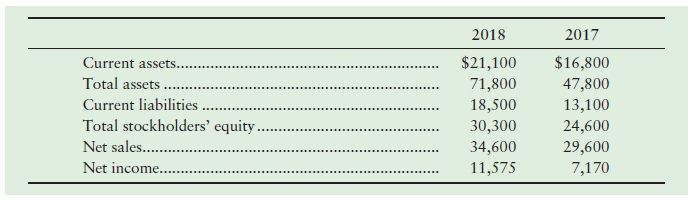

The Juice Company reported the following comparative information at December 31, 2018, and December 31, 2017 (amounts

Question:

The Juice Company reported the following comparative information at December 31, 2018, and December 31, 2017 (amounts in millions and adapted):

Requirements

1. Calculate the following ratios for 2018 and 2017:

a. Current ratio

b. Debt ratio

2. During 2018, The Juice Company issued $1,640 million of long-term debt that was used to retire short-term debt. What would the current ratio and debt ratio have been if this transaction had not been made?

3. The Juice Company reports that its lease payments under operating leases will total $910 million in the future and $160 million will occur in the next year (2019). What would the current ratio and debt ratio have been in 2018 if these leases had been capitalized?

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.