XYZ Ltd is a public company listed on the Australian Securities Exchange. You are provided with the

Question:

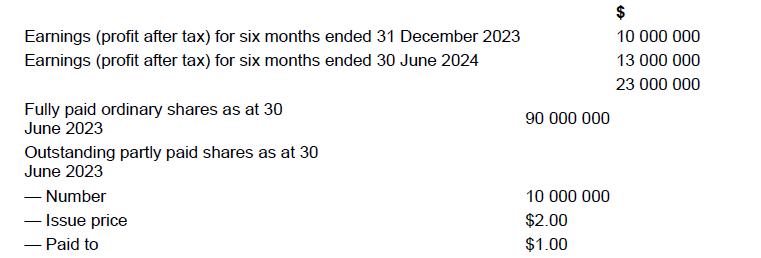

XYZ Ltd is a public company listed on the Australian Securities Exchange. You are provided with the following information about XYZ:

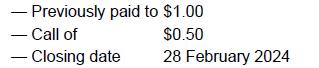

These shares were issued on 1 January 2023 and are payable over the following three years.

- The allotment of shares pursuant to the Dividend Reinvestment Plan was 1000000. ‘Dividend declared to shareholders registered in the books of the company at the close of business on 31 March 2024. The company will mail the dividend on 15 April 2024.’

- Call of partly paid shares during the year

- The current share price at reporting date is $2.50.

- The average share price for the year is $2.50.

- Ten million options were issued on 1 January 2022, exercisable at $2.60 on or before 31 December 2026.

- Ten million options were issued on 30 June 2022, exercisable at $2.10 on or before 30 June 2025.

- The company income tax rate is 40 per cent.

Required

Calculate basic earnings per share and diluted earnings per share as at 30 June 2024.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: