You are being given the balance sheets of two well-known companies, namely, Bank of India Limited (BOI)

Question:

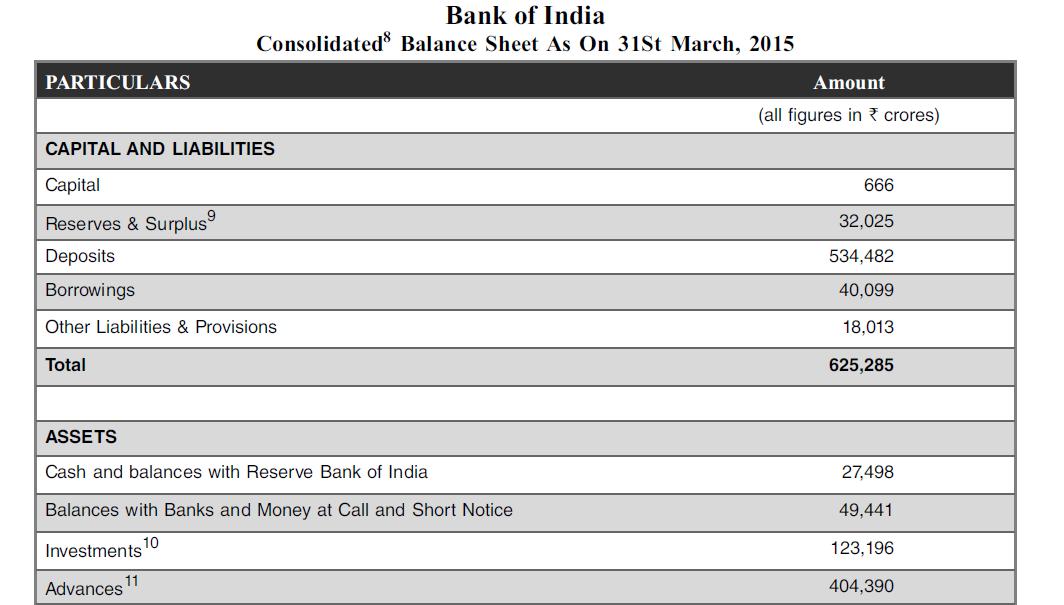

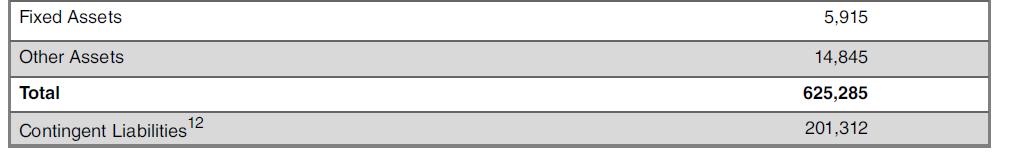

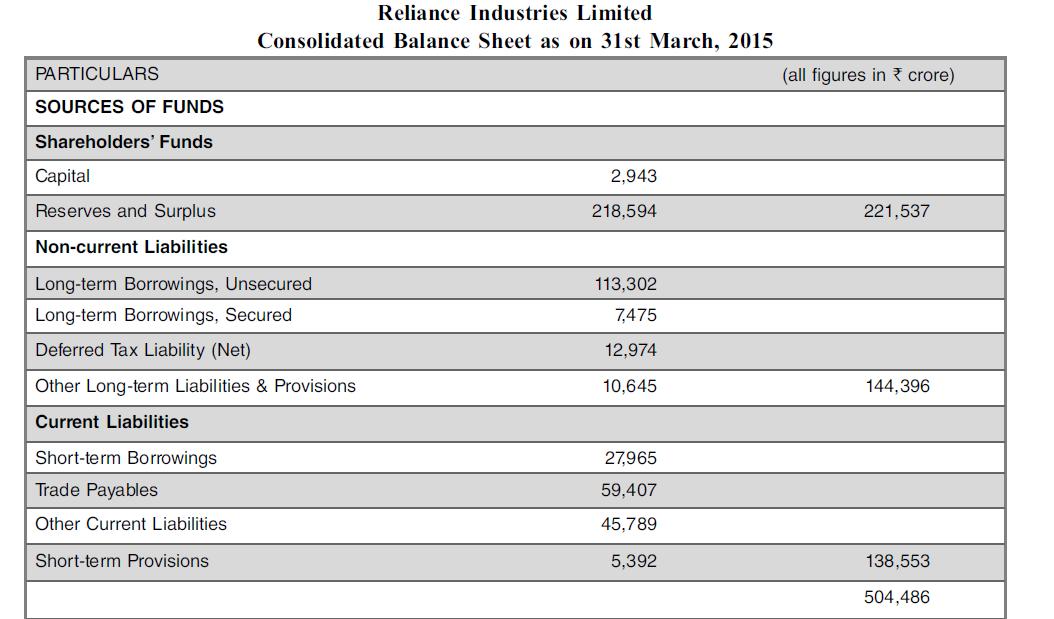

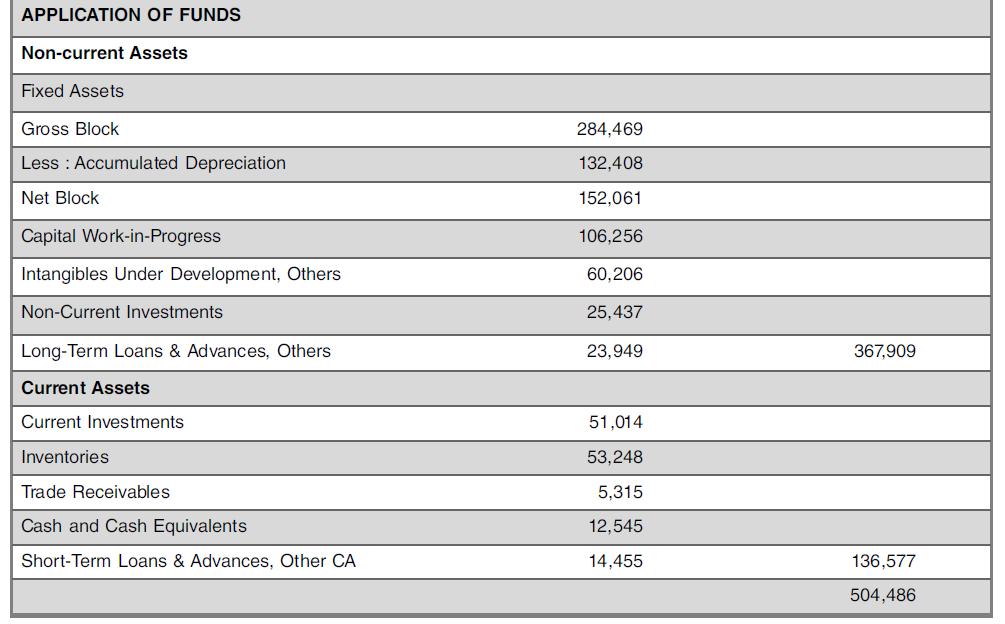

You are being given the balance sheets of two well-known companies, namely, Bank of India Limited (BOI) and Reliance Industries Limited (RIL). The first one is a large state-owned bank, the other is a large manufacturing company. Both the balance sheets seem to be very different. Prepare both of them in the Standard format and analyze the differences in the nature of the assets, liabilities, and owner(s).

8Consolidated financial statements are prepared by combining the financial results of a parent company and its subsidiaries (domestic as well as foreign). They reflect the financial position of the group (i.e., a company and its arms) as opposed to standalone numbers. They are prepared because the users of the financial statements of a parent are usually concerned with, and need to be informed about, the financial position and results of operations of not only the standalone enterprise itself but also of the group (i.e., a company and its arms) as a whole. Hence, a parent company releases both, standalone and consolidated financial statements.

9Includes minorities’ interest, explained.

10Investments here means investments by the bank in government securities, corporate debentures and to a small extent in equity markets (especially, blue chip companies).

11Advances are loans (both, long-term and short-term) given by the bank to corporates, individuals, and other entities.

12This is an off balance sheet item. It includes liability on account of outstanding contracts (such as foreign exchange contracts), swaps, claims against the Bank not acknowledged as debts & other similar items. This also includes bills for collection of ₹26,420 crore.

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani