You are the finance director of ME Ltd. The company specialises in importing classic foreign vehicles from

Question:

You are the finance director of ME Ltd. The company specialises in importing classic foreign vehicles from overseas countries and then selling these vehicles cheaply on the open market. The company’s financial year ends on 30 June. The company enters into the following transactions during the year:

a.

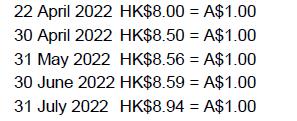

The company purchases inventories from Hong Kong for HK$300 000. The order is placed on 22 April 2022, with delivery due by 30 April 2022. Under the conditions of the contract, title to the goods passes to the company on delivery. Payment in respect of these inventories is due in equal instalments on 31 May 2022, 30 June 2022 and a final payment on 31 July 2022. The following exchange rates are applicable:

b.

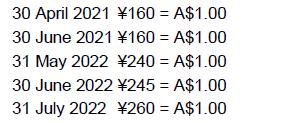

The company enters into a long-term construction contract with a Japanese company. Under the terms of the contract the Japanese firm will manufacture an engine diagnosis machine, which can be used on all classic cars. The contract is entered into on 30 April 2021 for a fixed price of ¥5 million. The equipment is delivered on 31 May 2022, subject to a two-month credit period after the date of delivery to ensure that the company is satisfied with the equipment. Payment falls due on 31 July 2022. The following exchange rates are applicable:

c.

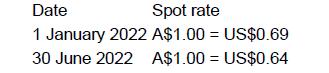

The company arranges a US-dollar interest-only loan on 1 January 2022 for US$20 million. The loan is for a 10-year period at an interest rate of 11.5 per cent per annum. Interest is payable annually. The following exchange rates are applicable:

d.

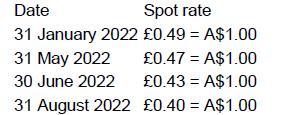

The company has agreed to purchase 10 new handmade sports cars from an English supplier. The official order for the vehicles is placed on 31 January 2022. The contract price is established at £350 000 and delivery takes place on 31 May 2022, as agreed. Payment is due in respect of these vehicles on 31

August 2022. The following exchange rates are applicable:

REQUIRED

Prepare the journal entries to reflect the effects of the above transactions in accordance with AASB 121, AASB 123 and AASB 9. Explain the treatment adopted in respect of each of the above transactions. Also, how important would it be for this organisation to consider entering hedging arrangements?

Step by Step Answer: