Andres is taxed at a 17% tax rate for his federal taxes. Last year, he reduced his

Question:

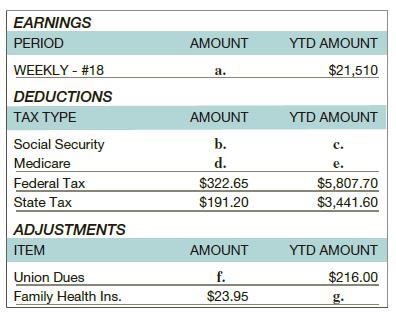

Andres is taxed at a 17% tax rate for his federal taxes. Last year, he reduced his taxable income by contributing $350 per biweekly paycheck to his tax-deferred retirement account and $50 per biweekly paycheck to his FSA. How much did he reduce his annual federal taxes by if his gross biweekly pay is $1,870?

Transcribed Image Text:

EARNINGS PERIOD WEEKLY - #18 DEDUCTIONS TAX TYPE Social Security Medicare Federal Tax State Tax ADJUSTMENTS ITEM Union Dues Family Health Ins. AMOUNT a. AMOUNT b. d. $322.65 $191.20 AMOUNT f. $23.95 YTD AMOUNT $21,510 YTD AMOUNT C. e. $5,807.70 $3,441.60 YTD AMOUNT $216.00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Amount he reduce his annua...View the full answer

Answered By

Willis Omondi

Hi, I'm Willis Omondi, a proficient and professional academic writer. I have been providing high-quality content that best suits my clients and completing their work within the deadline. All my work has been 100% plagiarism-free, according to research from my services, especially in arts subjects and many others

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Algebra Advanced Algebra With Financial Applications

ISBN: 9781337271790

2nd Edition

Authors: Robert Gerver, Richard J. Sgroi

Question Posted:

Students also viewed these Mathematics questions

-

Because income from fixed income assets is taxed at a higher income tax rate than capital gains and dividends from equities, there is no reason that one would have fixed income assets in a taxable...

-

Martina is taxed at a rate of 25% for her federal taxes. Last year, she reduced her taxable income by contributing to a flexible savings plan in the amount of $2,700. If her wages before the...

-

How much federal income tax should Aman report if she earned taxable income of $32 920 and $17 700 from her two jobs? Use the 2012 federal income tax brackets and rates in Table 3.3 to answer the...

-

Listed below is the income statement for Tom and Sue Travels, Incorporated. TOM AND SUE TRAVELS, INCORPORATED Income Statement for Year End ( in millions of dollars ) Net sales $ 1 9 . 6 0 0 Less:...

-

The Northwest Pacific Phone Company wishes to estimate the average number of minutes its customers spend on long-distance calls per month. The company wants the estimate made with 99% confidence and...

-

Determine the speed of the boat with respect to the shore in Example 3-11.

-

Refer to the data for E5-16A. However, instead of the FIFO method, assume Austins Jewelers uses the average cost method. Requirements 1. Prepare a perpetual inventory record for the watches on the...

-

You expect to invest your funds equally in four stocks with the following expected returns: Stock Expected Return A........ 16% B........ 14 C........ 10 D........ 8 At the end of the year, each...

-

Solve using quadratic formula x = 5x-12= 2x

-

Ryan Holeman, the president of Nine Iron Ltd, has come to your office seeking a second opinion. Nine Iron Ltd. carries on a mini golf and retail business in southem Manitoba. The CRA has reassessed...

-

Use Tax Schedule Y-1 from Example 1 and Exercises 5 and 6. Select any income. Write an equation for that income for the three different years. Data From Exercise 6 Use the 2012 Schedule Y-1 for a...

-

For what taxable income would a taxpayer have to pay $26,277.50 in taxes? Explain your reasoning. Schedule Z-If your filing status is Head of household If your taxable income is: Over- $0 13,150...

-

Find the number of different arrangements for the Instant Insanity blocks.

-

The one year Treasury Bond yield is 6% and one year B-rated corporate bond yield is 10%. What are the implied probability of repayment and the default rate on two-year B-rated debt?

-

Suppose an asset provides annual risk-free cash flows at the end of each year in perpetuity. The risk-free rate is 5%. The first cash flow is $200, and the cash flows grow at 4% per year. What is the...

-

A bank purchases $60,000 in bonds from a bond dealer who has a checking account at the bank. show how the bank's balance sheet be affected by this change. Only list the changes on your balance sheet....

-

ROA of a company is 8.57%, Total assets end of the year of 2021 are $9.6 million, ROE is 14% and Profit margin of 19.9% what is the firms value of net income? and what is stockholders equity?

-

Gene and Tina are playing darts. Gene hasn't played before and when he throws his first dart, he throws it from exactly the same height as the bullseye and throws horizontally at the bullseye. He...

-

Brunell Products has projected the following sales for the coming year: Sales in the year following this one are projected to be 15 percent greater in each quarter. a. Calculate payments to suppliers...

-

$10,000 was borrowed at 3.5% on July 17. The borrower repaid $5000 on August 12, and $2000 on September 18. What final payment is required on November 12 to fully repay the loan?

-

Select the third point from each of the six samples, and compute the sample sd from the collection of six third points? Table 6.2: Sample of birth-weights (oz) obtained from 1000 consecutive...

-

What theoretical relationship should there be between the standard deviation in Problem 6.48 and the standard deviation in Problem 6.49? Table 6.2: Sample of birth-weights (oz) obtained from 1000...

-

How do the actual sample results in Problems 6.48 and 6.49 compare? Obstetrics Figure 6.4b (p. 172) plotted the sampling distribution of the mean from 200 samples of size 5 from the population of...

-

Glitz hotel is going to make a $2,000,000 investment by completing renovating a floor of the hotel.The floorplan will be entirely redone, and they can have a mix of three types of rooms: Luxury...

-

Suppose that you own the only company in the market to produce a certain product, and therefore you can determine the market price P dollars for each unit. Due to government regulations, the price of...

-

Let be a function that satisfies the following properties: f(x+y)= f(x)f(y) for all r. y R, and f'(0) = 1. a. Explain why f is continuous at x=0. b. Show the following two facts: that f(0) = 1, and...

Study smarter with the SolutionInn App