It was Monday morning at 8 a.m. John was pacing the front of the room, waiting for

Question:

It was Monday morning at 8 a.m. John was pacing the front of the room, waiting for each of his key managers to make their way to a seat. As he glanced around, he saw a lot of weary and anxious faces—not a good sign. By 8:10, everyone was seated, and the meeting got under way.

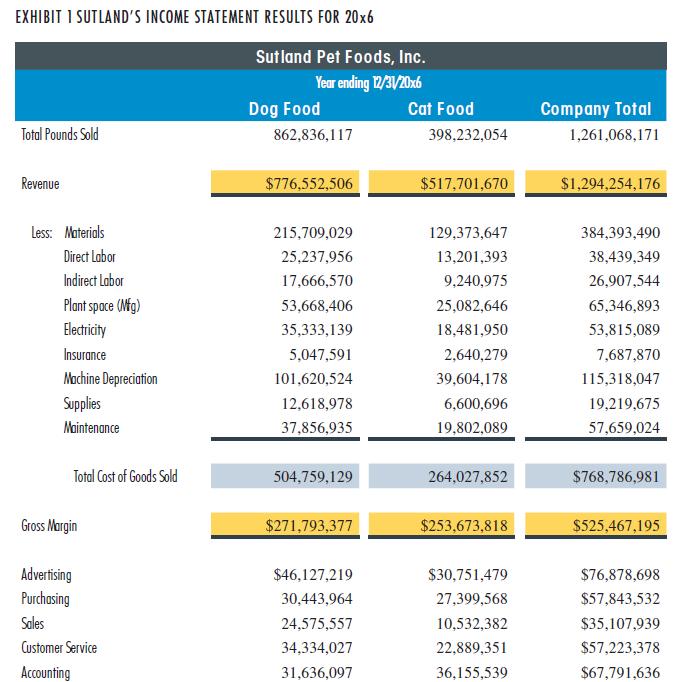

John: You all know why we’re here. As you can see from Exhibit 1, the results for 20x6 are dismal, and the board wants to know why. Simply saying that the new plant is taking longer to get up to speed than we thought it would isn’t going to cut it. The board wants details.

Sue, Marketing VP: All I know is we hit our sales projections right on the nose. There was some resistance to the price increases, but we were able to hit our sales goals and keep the majority of our customers. We did our job, that’s all I can say.

Adam, Production VP: Guess that depends on what you call “sales goals.” As far as I can see, total shipments for both product lines are down. We have a lot of fixed costs around here, so when the volumes drop like they have, we’re in trouble.

John: Let’s save the finger-pointing for later. Right now we need teamwork, not arguments. I agree that marketing hit its dollar goals, and also, that volumes are down. These are obvious facts. The issue is…what are we going to do about them?

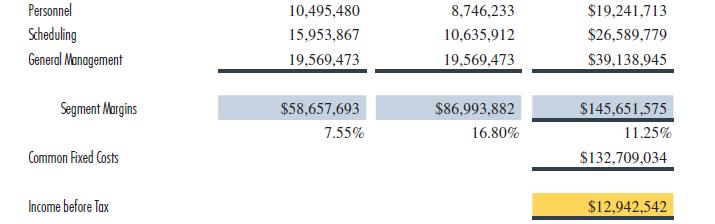

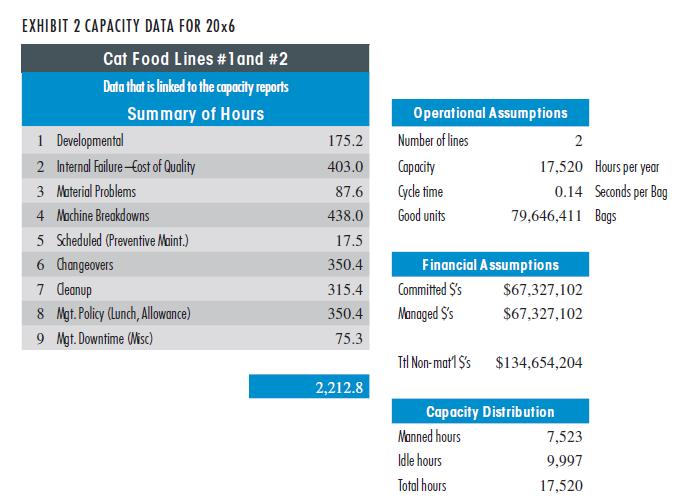

Adam: You’re right, John; sorry, Sue. Anyway, on a more positive note, we did a study of the plant’s capacity utilization for last year, Exhibit 2 in today ’s materials. My thanks to Wendy for Finance’s help in sorting the costs into committed and managed capacity costs for each sub plant (cat and dog food production), so we could get a general idea of what was going on.

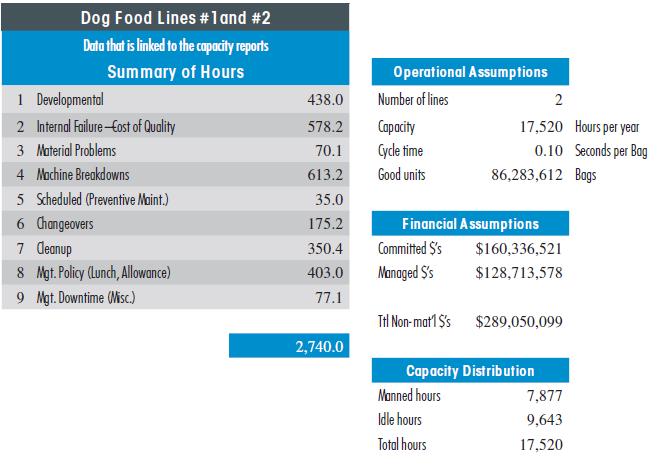

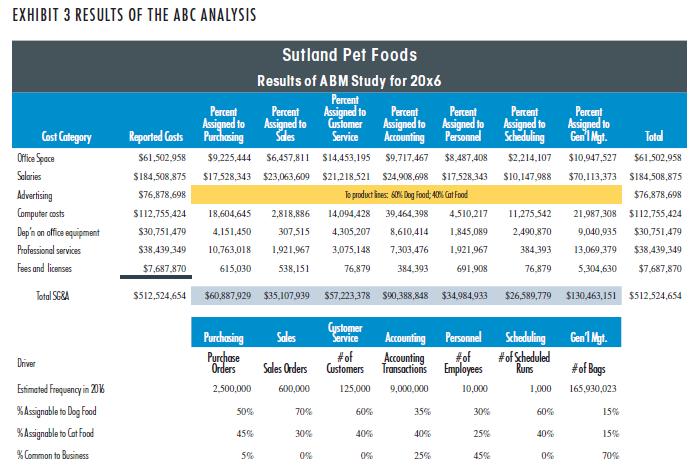

Wendy, CFO: I’m glad you found the information useful, A dam. I wanted you to know, Sue, that we also used the two weeks to do a first pass at developing a better understanding of the back office using activity-based costing. I’ve wanted to look at the business that way for a while, and thought there was no better time than the present. The information is Exhibit 3—the page I handed out when you walked in.

Adam: Interesting stuff, but the new look at the factory you gave me combined with this one of the back office still leaves me a bit confused. I’d like to see these developed further so I can see where I need to focus.

John: I agree with you, Adam. In fact, I think I’d like to set the data aside for now and return to it at our next meeting. In the meantime, Wendy, can you tell me what the minimum costs of production are right now? And, if we were to take your ABCM data, what would the profitability of the two product lines look like?

Wendy: We’ll give it a shot.

John: Okay, Wendy. In the meantime, A dam, I’d like you to help me understand how we are using our hours in production. What is this “cycle time” number? And, Wendy, I need to know how we’re going to get volumes back up. Let’s brainstorm for the next few hours and see what we can come up with.

REQUIRED:

Using the information provided in these exhibits, including the financial statements for the last year, answer the following:

a. Capacity analysis: What are SPFI’s committed and managed costs per hour for the two lines in 20x6? Using this information, and the cycle time estimates, what is the competitive (that is, “good”) cost for a bag of cat food? Dog food?

b. Capacity analysis: What is the total percentage and dollars for productive, nonproductive, and idle capacity for the two product lines for 20x6? How do they compare?

c. Activity- based cost management analysis: Using the information that is presented in Exhibit 3, calculate the activity costs for each of the activities Wendy’s staff identified. Assign these costs to cat food or dog food using the percentages given.

d. ABCM analysis. Using the results of (c), how do you feel about the accuracy of this information? What would you like to know to better understand these results?

e. What should John do to correct the problems facing his firm? Please back up your recommendations with relevant case facts.

Step by Step Answer:

Managerial Accounting An Integrative Approach

ISBN: 9780999500491

2nd Edition

Authors: C J Mcnair Connoly, Kenneth Merchant