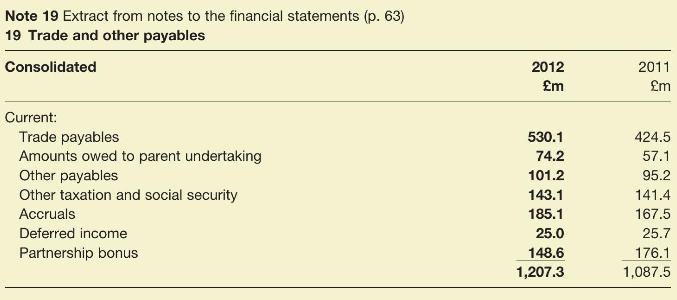

The following extracts relating to suppliers and accounts payable are taken from the annual report of the

Question:

The following extracts relating to suppliers and accounts payable are taken from the annual report of the John Lewis Partnership.

Customers, products and suppliers (Extract from Business Review, p. 20)

The Partnership's vision is for long term sustainable trading. We are committed to selling responsibly sourced products, dealing fairly with suppliers, engaging with and acting in the interests of our

customers and providing excellent value and unrivalled customer service.

In 2011 Waitrose came first in Which? magazine's supermarket survey of over 12,000 shoppers and John Lewis was voted Britain's favourite retailer for the fourth year running by retail analysts Verdict. The Partnership works with over 5,000 suppliers to sell quality products, supported by ethical and environmental standards and policies, paying them a fair price and helping them to reinvest in their businesses.

In June 2011, the Partnership joined the Ethical Trading Initiative (ETI), a collaborative arrangement between businesses, trade unions and NGOs which aims to improve the lives of workers internationally.

The Partnership has two supply chain foundations: the Waitrose Foundation established in 2005, which contributed \(£ 550,000\) to projects supporting communities in Waitrose's supply chain in Africa in 2011/12; and the John Lewis Foundation which has invested \(£ 58,500\) in 2011/12 in projects which support and service the communities where John Lewis products are sourced.

Payments to suppliers (Extract from Directors' Report, p. 30)

The group's policy on the payment of its suppliers is to agree terms of payment in advance and, provided a supplier fulfils the agreement, to pay promptly in accordance with those terms. The group's trade creditors at 28 January 2012 were equivalent to 27 days of average purchases (2011: 24 days).

Discussion points

1 How does the narrative information add insight into the nature of the liability for trade payables?

2 The total equity in the statement of financial position is \(£ 2008.9 \mathrm{~m}\). How significant are trade payables to the financing of the company?

Step by Step Answer:

Financial And Management Accounting An Introduction

ISBN: 9780273789215

6th Edition

Authors: Prof Pauline Weetman