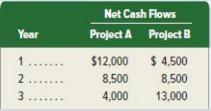

A company is considering two potential projects. Each project requires a ($ 20,000) initial investment and is

Question:

A company is considering two potential projects. Each project requires a \(\$ 20,000\) initial investment and is expected to generate annual net cash flows as follows. Assuming a discount rate of \(10 \%\), compute the net present value of each project. If only one project can be selected, which is chosen?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: