Amazon.com, Inc., provides the following explanation of its revenue recognition policies in its 2010 (10-mathrm{K}) report. Required

Question:

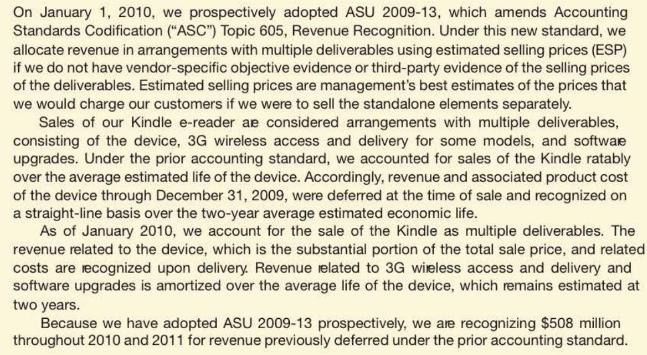

Amazon.com, Inc., provides the following explanation of its revenue recognition policies in its 2010 \(10-\mathrm{K}\) report.

Required

a. What is a multiple-element contract? What product did Amazon sell that involved a multipleelement contract? Explain.

b. Explain how companies account for multiple-element contracts, in general.

c. Compare the accounting for the Kindle under the old and new accounting standards for revenue recognition. Amazon disclosed that \(\$ 508\) million of previously deferred revenue would now be recognized earlier. Explain.

d. Assume that Amazon sold a Kindle with 3G capabilities for \(\$ 180\) and the company estimated a selling price (ESP) of \(\$ 20\) per unit for \(3 \mathrm{G}\) access and future software upgrades. Compute the revenue that Amazon would recognize at the point of sale under the old and the new accounting standards.

e. Use the financial statement effects template to record the initial sale of a Kindle and the accounting adjustment required at the end of the first quarter for the new accounting standards.

adjustment required at the end of the first quarter for the new accounting standards.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton