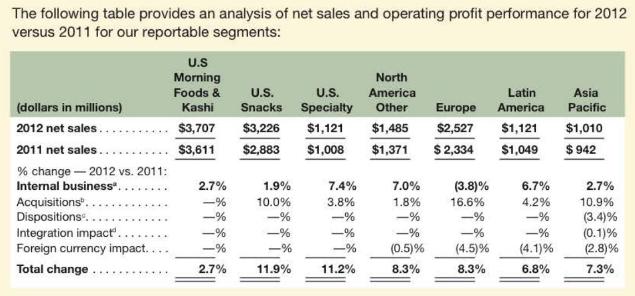

Analyzing and Interpreting Foreign Currency Translation Effects Kellogg Co. reports the following table and discussion in its

Question:

Analyzing and Interpreting Foreign Currency Translation Effects Kellogg Co. reports the following table and discussion in its 2012 10-K.

Before the effects of foreign currency rates, total consolidated sales increased by \(7.6 \%\) during 2012. What geographic segment accounted for this overall increase? What other factor explains this significant increase? (Hint: see the footnotes to the tables.)

b. How did foreign currency exchange rates affect sales at each of the geographic segments? What can we infer about the strength of the U.S. dollar vis-à-vis the currencies in Kellogg's segments?

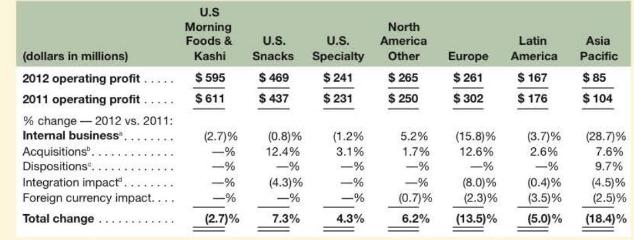

c. Operating profit was not uniformly affected, across the board. Which geographic segments exhibited the lowest and which the highest change in profit during the year? Explain.

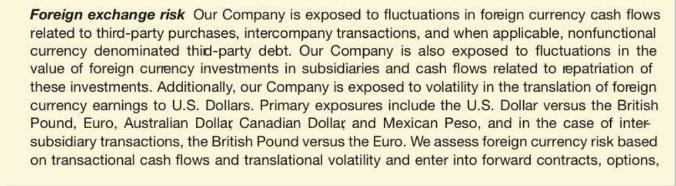

d. Describe how the accounting for foreign exchange translation affects reported sales and profits.

e. How does Kellogg Co. manage the risk related to its foreign exchange exposure? Describe the financial statement effects of this risk management activity.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton