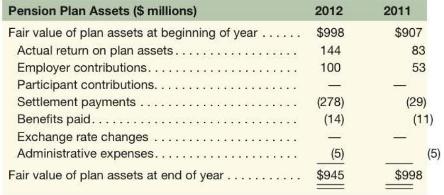

Analyzing and Interpreting Pension Disclosures-Plan Assets and Cash Flow YUM! Brands, Inc., discloses the following pension footnote

Question:

Analyzing and Interpreting Pension Disclosures-Plan Assets and Cash Flow YUM! Brands, Inc., discloses the following pension footnote in its 10-K report.

a. How does the "actual return on plan assets" of \$144 million affect YUM!'s reported profits for 2012?

b. What are the cash flow implications of the pension plan for YUM! in 2012?

c. YUM!'s pension plan paid out \(\$ 14\) million in benefits during 2012. Where else is this payment reflected?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton

Question Posted: