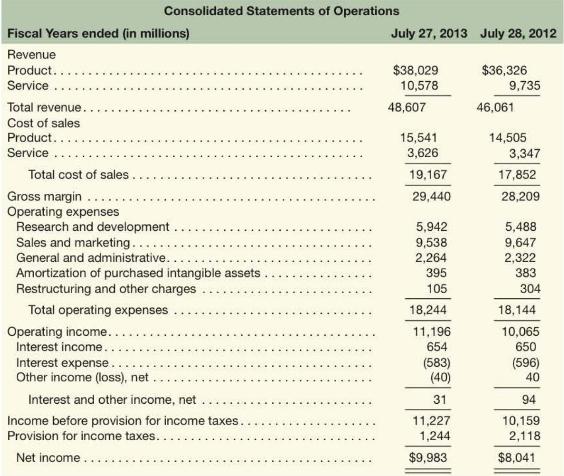

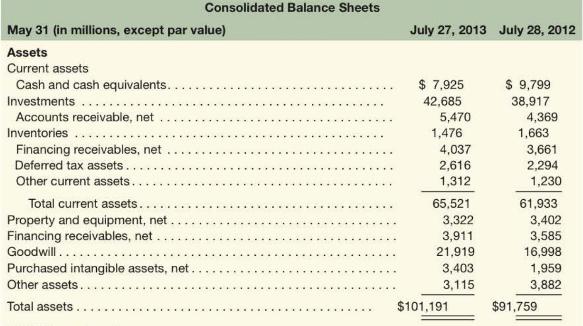

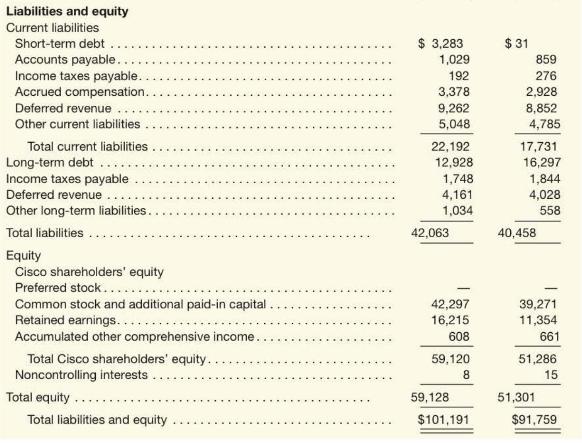

Following are fiscal year financial statements of Cisco Systems, Inc. Required Forecast Cisco's fiscal 2014 income statement,

Question:

Following are fiscal year financial statements of Cisco Systems, Inc.

Required

Forecast Cisco's fiscal 2014 income statement, balance sheet, and statement of cash flows; round forecasts to \(\$\) millions.. Cisco's long-term debt footnote reports that current maturities of longterm debt are \(\$ 3,260\) million for fiscal year 2014 and \(\$ 507\) million for fiscal year 2015; Cisco includes the current maturities with "Short-term debt" on its balance sheet. Cisco reports capital expenditures of \(\$ 1,160\) million, dividends of \(\$ 3,310\) million, depreciation of \(\$ 1,178\) million, which it includes in G\&A expense, and amortization of \(\$ 395\) million, which it reports separately. Identify all financial statement relations estimated and assumptions made; estimate forecasted income statement relations to 3 decimal places, for example, General and administrative/Total revenue is \(4.7 \%\). Assume no change for interest income and expense, goodwill, other long-term assets, amortization of purchased intangible assets, nonoperating income, common stock, accumulated other comprehensive income, and noncontrolling interests. What do the forecasts imply about the financing needs of Cisco?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton