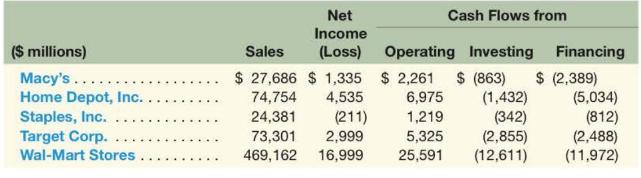

Following are selected accounts from the income statement and the statement of cash flows for several retailers,

Question:

Following are selected accounts from the income statement and the statement of cash flows for several retailers, for their fiscal years ended in 2013.

Required

a. Compute the ratio of net income to sales for each company. Rank the companies on the basis of this ratio. Do their respective business models give insight into these differences?

b. Compute net cash flows from operating activities as a percentage of sales. Rank the companies on the basis of this ratio. Does this ranking coincide with the ratio rankings from part

(a) ? Suggest one or more reasons for any differences you observe.

c. Compute net cash flows from investing activities as a percentage of sales. Rank the companies on the basis of this ratio. Does this ranking coincide with the ratio rankings from part

(a) ? Suggest one or more reasons for any differences you observe.

d. All of these companies report negative cash flows from financing activities. What does it mean for a company to have net cash outflow from financing?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton