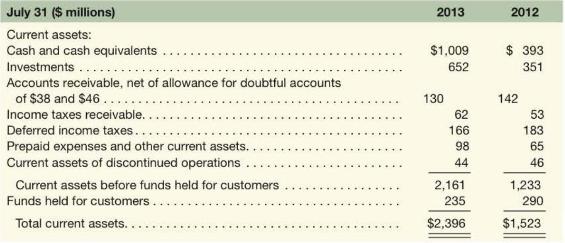

Following is the current asset section from Intuit Inc.'s balance sheet. Total revenues were ($ 4,171) million

Question:

Following is the current asset section from Intuit Inc.'s balance sheet.

Total revenues were \(\$ 4,171\) million ( \(\$ 1,515\) million in product sales and \(\$ 2,656\) million in service revenues and other) in 2013.

Required

a. What are Intuit's gross accounts receivable at the end of 2012 and 2013 ?

b. For both 2013 and 2012, compute the ratio of the allowance for uncollectible accounts to gross receivables. What trend do you observe?

c. Compute the receivables turnover ratio and the average collection period for 2013 based on gross receivables computed in part \(a\). Does the collection period (days sales in receivables) appear reasonable given Intuit's lines of business (Intuit's products include QuickBooks, TurboTax and Quicken, which it sells to consumers and small businesses)? Explain.

d. Is the percentage of Intuit's allowance for uncollectible accounts to gross accounts receivable consistent with what you expect for Intuit's line of business? Explain.

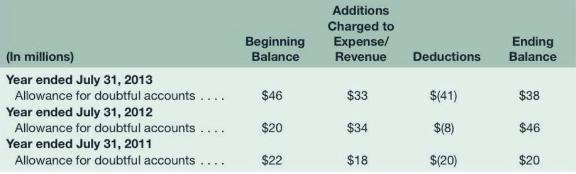

e. Intuit discloses the following table related to its allowance for uncollectible accounts from its 10-K. Comment on the change in the allowance account during 2011 through 2013.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton