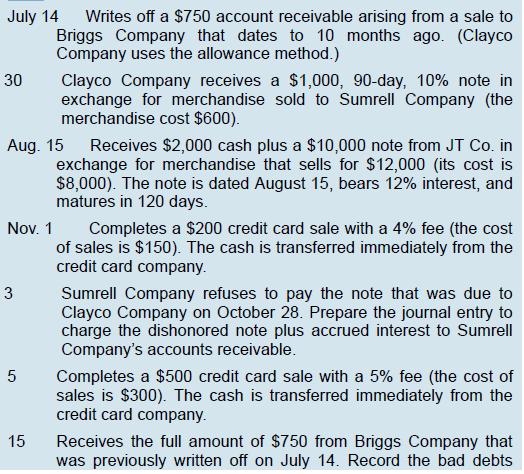

Recording Accounts and Notes Receivable Transactions; Estimating Bad Debts Clayco Company completes the following transactions during the

Question:

Recording Accounts and Notes Receivable Transactions; Estimating Bad Debts Clayco Company completes the following transactions during the year.

Required

1. Prepare Clayco Company’s journal entries to record these transactions.

2. Prepare a year-end adjusting journal entry as of December 31 for each separate situation.

a. Bad debts are estimated to be $20,400 by aging accounts receivable. The unadjusted balance of the Allowance for Doubtful Accounts is a $1,000 debit.

b. Alternatively, assume that bad debts are estimated using the percent of sales method. The Allowance for Doubtful Accounts had a $1,000 debit balance before adjustment, and the company estimates bad debts to be 1% of its credit sales of $2,000,000.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: