Refer to the financial information of 3M Company in P4-36 to answer the following requirements. Required a.

Question:

Refer to the financial information of 3M Company in P4-36 to answer the following requirements.

Required

a. Compute its financial leverage (FLEV), Spread, and noncontrolling interest (NCI) ratio for 2012. Recall that NNE \(=\) NOPAT - Net income.

b. Assume that its return on equity (ROE) for 2012 is \(26.94 \%\) and its return on net operating assets \((\) RNOA) is \(26.65 \%\). Confirm computations to yield the relation: \(\mathrm{ROE}=[\mathrm{RNOA}+(\mathrm{FLEV} \times\) Spread)] \(\times\) NCI ratio.

c. What do your computations of the nonoperating return imply about the company's use of borrowed funds?

Q4-36

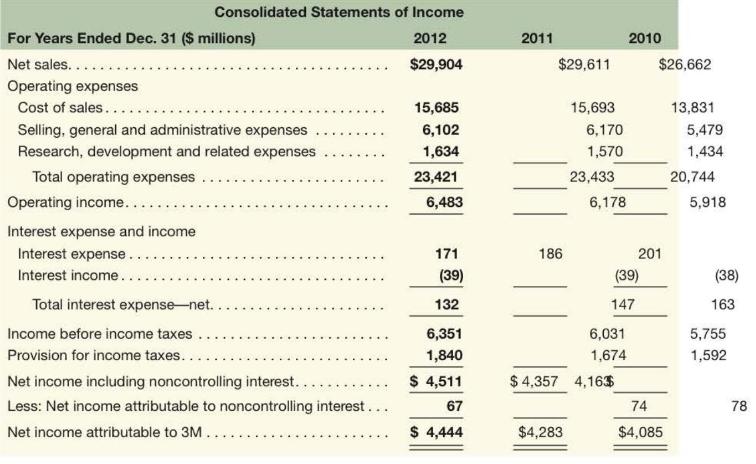

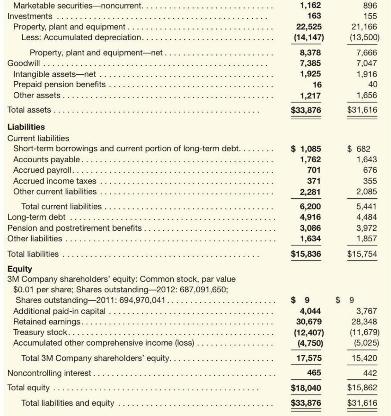

Balance sheets and income statements for 3M Company follow.

Required

a. Compute net operating profit after tax (NOPAT) for 2012. Assume that the combined federal and state statutory tax rate is \(37 \%\).

b. Compute net operating assets (NOA) for 2012 and 2011. Treat noncurrent investments as a nonoperating item.

c. Compute and disaggregate 3M's RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2012. Demonstrate that RNOA \(=\) NOPM \(\times\) NOAT.

d. Compute net nonoperating obligations (NNO) for 2012 and 2011. Confirm the relation: \(\mathrm{NOA}=\) NNO + Stockholders' equity.

e. Compute return on equity (ROE) for 2012.

\(f\). What is the nonoperating return component of ROE for 2012 ?

g. Comment on the difference between ROE and RNOA. What inference can we draw from this comparison?

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton