Statoil ASA, headquartered in Stavanger Norway is a fully integrated petroleum company The company uses IFRS to

Question:

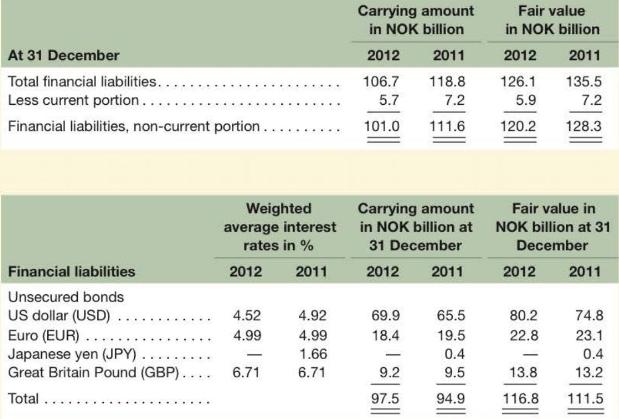

Statoil ASA, headquartered in Stavanger Norway is a fully integrated petroleum company The company uses IFRS to prepare its financial statements. Reproduced below is the long-term debt note from its 2012 annual report.

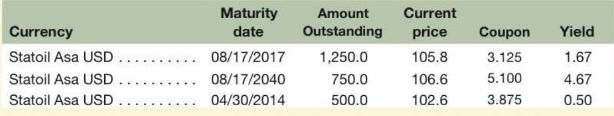

Reproduced below is a summary of the market values, at July 2013, of the Statoil ASA bonds maturing from 2014 to 2040

Required

a. What is the amount of total financial liabilities (debt) reported on Statoil's 2012 balance sheet? Of the total financial liabilities, what proportion is due within one year?

\(b\). In what currencies has Statoil issued financial liabilities? Why do companies borrow money in foreign currencies?

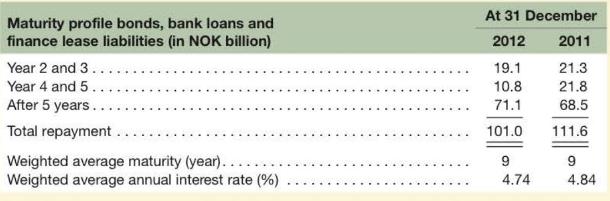

c. What are the scheduled maturities for Statoil's indebtedness? Why is information relating to a company's scheduled maturities of debt useful in analyzing financial condition?

d. Statoil's long-term debt is rated AA- by Standard and Poor's and similarly by other credit agencies. What factors would be important to consider in quantifying the relative riskiness of Statoil compared to other borrowers? Explain.

e. Statoil's \(\$ 1,250\) million, \(3.125 \%\) notes traded at 105.8 or \(105.8 \%\) of par, as of July 2013 . What is the market value of these notes on that date? How is the difference between this market value and the \(\$ 1,250\) million face value reflected on Statoil's financial statements? What does the 105.8 price tell you about the general trend in interest rates since Statoil sold this bond issue? Explain.

f. Examine the yields to maturity of the bonds in the previous table. What relation do we observe between these yields and the maturities of the bonds? Explain why this relation applies in general.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton