The following four items are reproduced from Verizon Communications 2012 10-K: its income statement, its balance sheet's

Question:

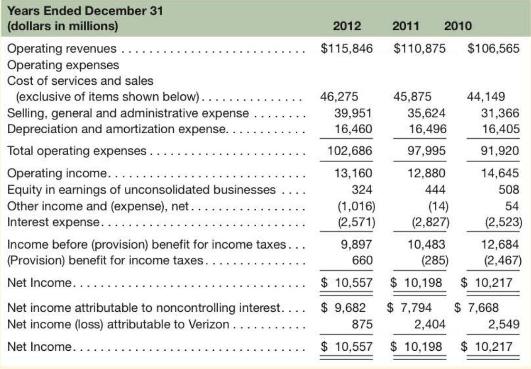

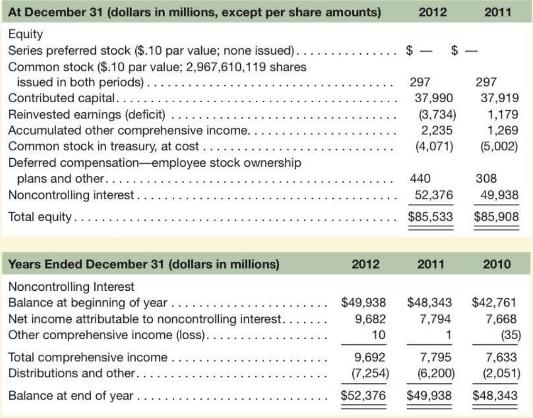

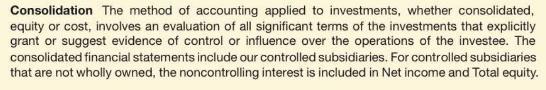

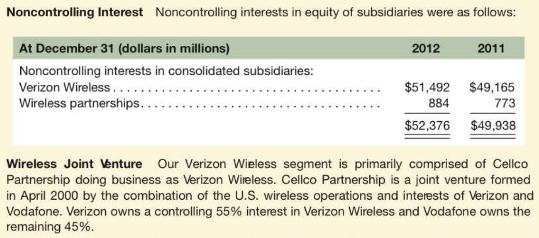

The following four items are reproduced from Verizon Communications 2012 10-K: its income statement, its balance sheet's stockholders' equity section, its noncontrolling interest section from the statement of changes in stockholders' equity, and its footnotes relating to noncontrolling interests.

Required

a. What are noncontrolling interests and how are they accounted for?

b. The noncontrolling interests relate primarily to a joint venture between Verizon and Vodafone described in the footnote. Why does Verizon consolidate this joint venture rather than to account for its investment using the equity method? What are the financial reporting implications for the decision to consolidate the joint venture?

c. What does the significant amount of net income allocated to the noncontrolling interests imply about the profitability of the wireless subsidiary relative to other subsidiaries in the consolidated entity?

d. What does the "Distributions and other" line with an amount of \(\$(7,254)\) million in the noncontrolling interest portion of the statement of changes in stockholders' equity relate to?

e. How should we treat noncontrolling interests in our return on equity (ROE) computation? Compute ROE for both the Verizon shareholders and for the noncontrolling interests.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton