The following information relates to Fannings Electronics on December 31. a. The companys weekly payroll is $8,750,

Question:

The following information relates to Fanning’s Electronics on December 31.

a. The company’s weekly payroll is $8,750, paid each Friday for a five-day workweek. Assume December 31 falls on a Monday, but the employees will not be paid their wages until Friday, January 4 of next year.

b. At the beginning of the current year, the company purchased equipment that cost $20,000. Its useful life is predicted to be five years, at which time the equipment is expected to be worthless (zero salvage value).

c. On October 1, the company agreed to work on a new housing development. The company is paid $120,000 on October 1 in advance of future installation of similar alarm systems in 24 new homes. That amount was credited to the Unearned Revenue account. Between October 1 and December 31, work on 20 homes was completed.

d. On September 1, the company purchased a 12-month insurance policy for $1,800. The transaction was recorded with an $1,800 debit to Prepaid Insurance.

e. On December 29, the company completed $7,000 in services that have not been billed or recorded as of December 31.

Required

1. Prepare any necessary adjusting entries on December 31 of the current year related to transactions and events a through e.

2. Prepare T-accounts for the accounts affected by adjusting entries, and post the adjusting entries. Determine the adjusted balances for the Prepaid Insurance, Unearned Revenue, and Services Revenue accounts.

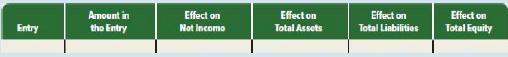

3. Complete the following table and determine the amounts and effects of each adjusting entry on the current year income statement and the year-end balance sheet.

Use up (down) arrows to indicate an increase (decrease) in the four “Effect on” columns.

Step by Step Answer: